Discovery

CONTEXT

2016 was a year of significant transition for TIAA. The company’s reputable retirement products and services were valued amongst the customers it already served, which predominantly consisted of Baby Boomers and Generation X.

During this year, TIAA recognized its struggle to attract and retain millennials, which set in motion a shift in brand towards competitive retail products that would be appealing to millennials while retaining existing customers.

RESEARCH

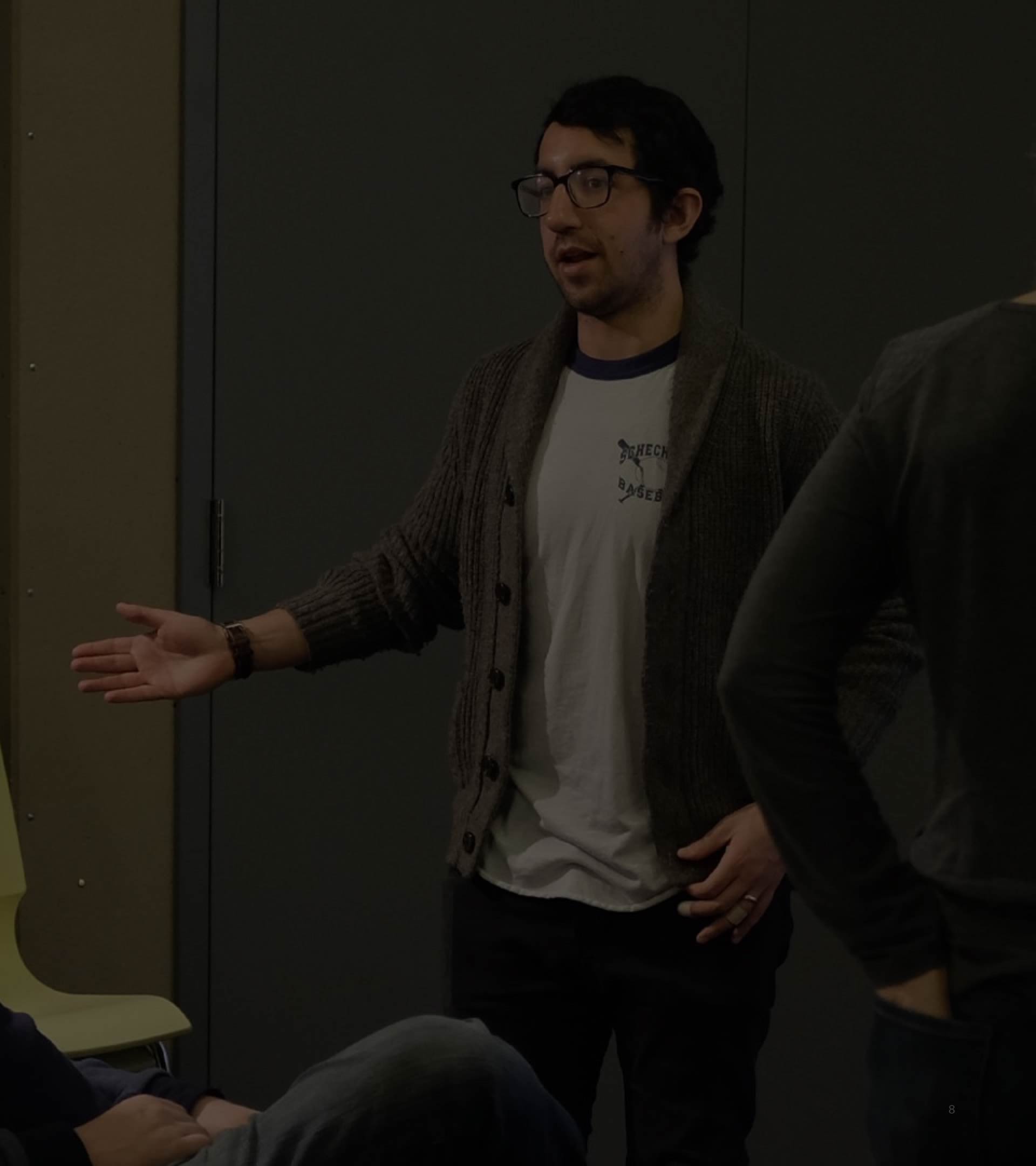

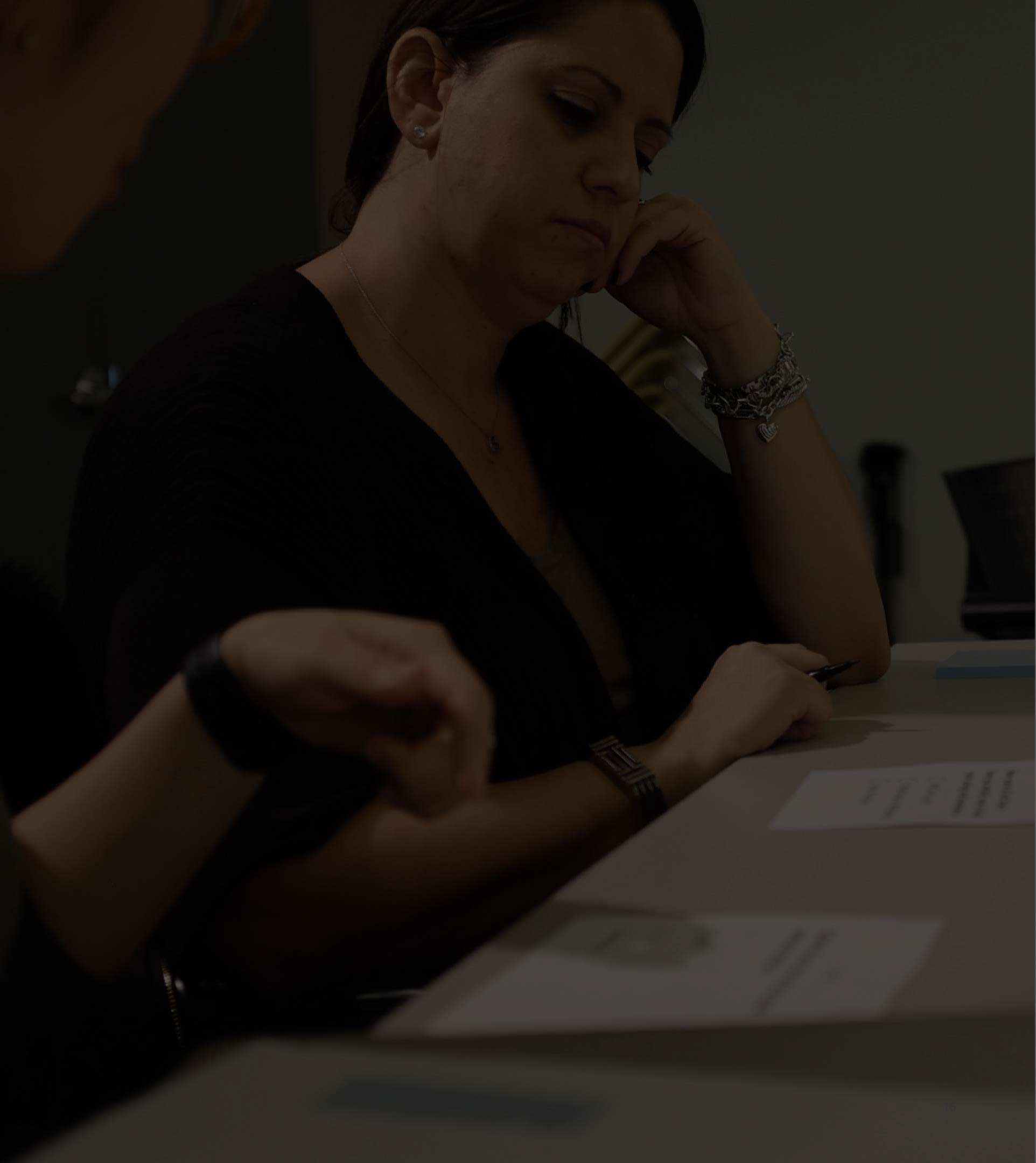

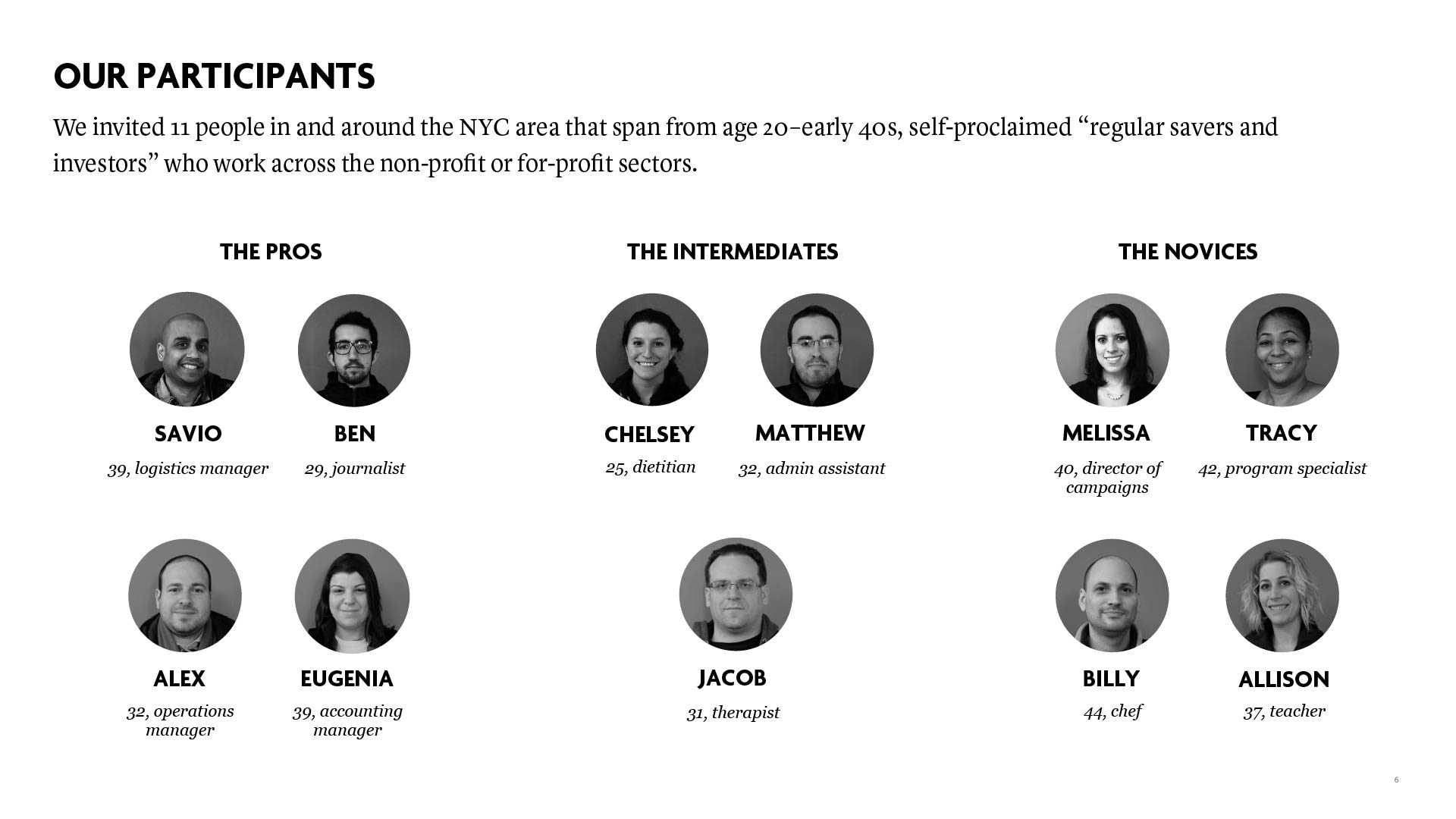

To help better understand the audience’s lifestyle and financial management habits, we interviewed 11 people in the New York City and the surrounding areas, ranging in ages 20 to early 40s. Topics covered included but were not limited to:

- Perceptions on Investing

- Saving and Investment Strategies

- Perceived Barriers and Expectations

- Trust and Credibility Building for Online Financial Experiences

- Investment Options

OBSERVATIONS

KEY INSIGHTS

After unpacking our observations, it was time to develop a meaningful and actionable design challenge. The challenge was framed in the form of “How might we” statements derived from users needs discovered during our research.

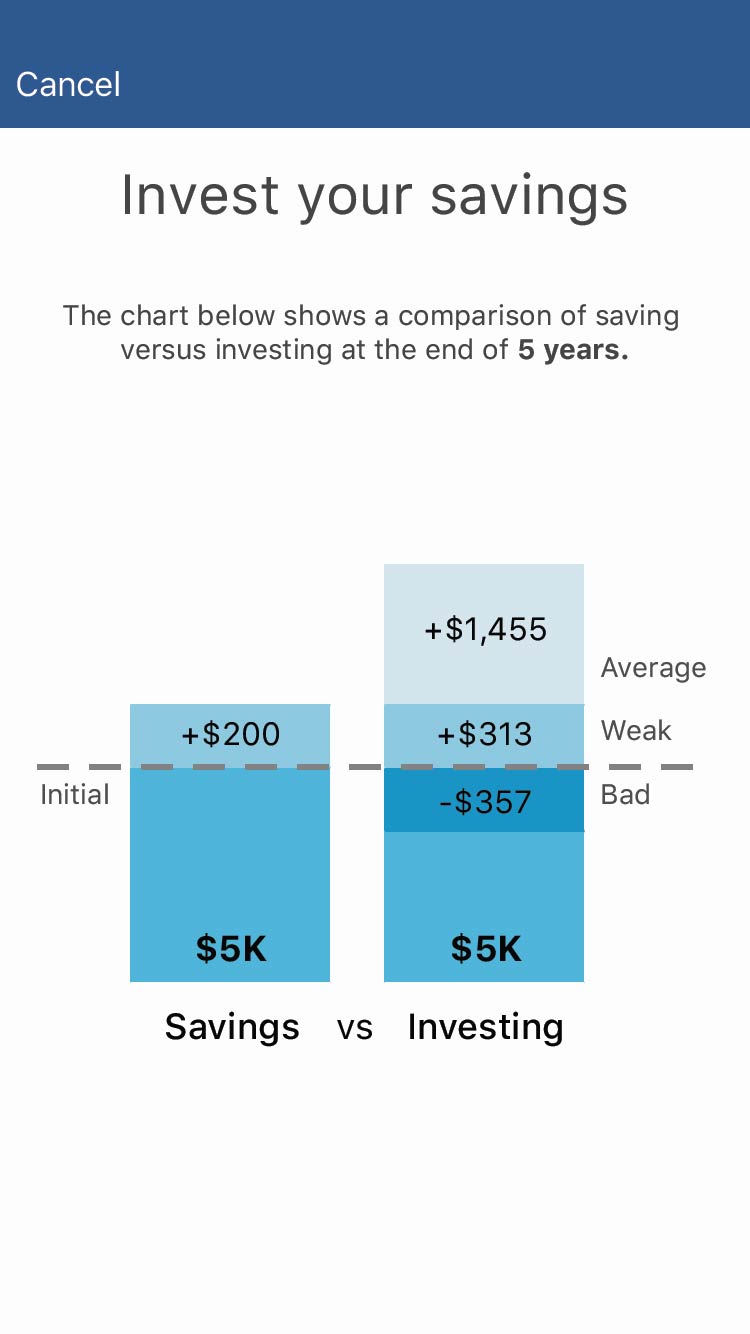

How might we educate Ben on the benefits of putting his money in an investment account when saving for financial goals 3+ years away?

How might we help Matthew set an achievable financial goal?

How might we ease Mellisa’s anxiety around the risk involved with investing?

How might we get Savio to adapt TIAA’s capabilities as another tool in his toolkit to help him manage his money?

Design

COMPETITIVE ANALYSIS

Since millennials were the primary focus, it was necessary and beneficial to research and analyze several start-ups within the financial industries that were known to attract millennials. This research was truly a learning experience that helped identify key factors and designs that attracted millennials. As a result, patterns were identified and a number of features were designed.

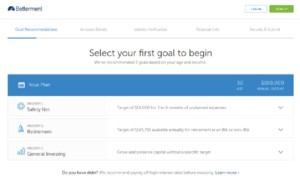

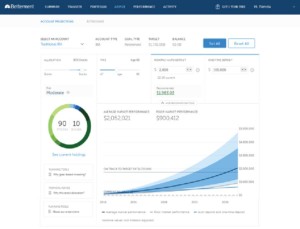

Betterment

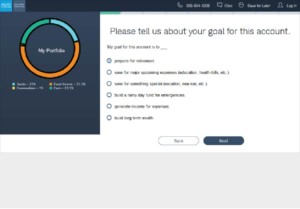

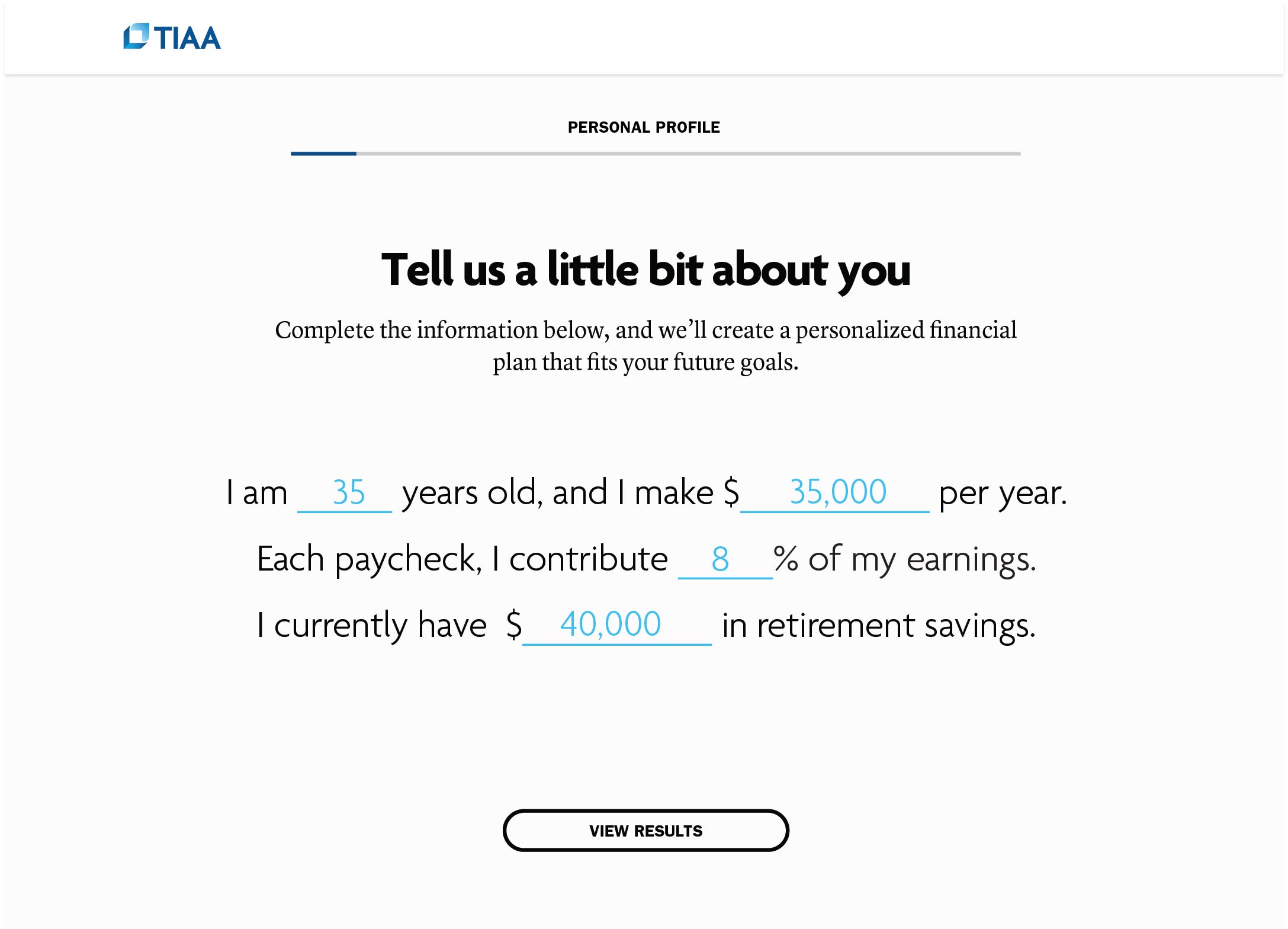

Betterment did a great job making it very simple to quickly collect the necessary data for goal creation.

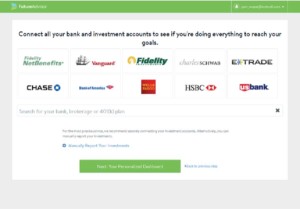

Future Advisor

Future advisor acknowledges your current trusted banking/investment relationship. They help customers better invest in their existing accounts, but you have to sign up for online access first.

Schwab Intelligent Portfolio

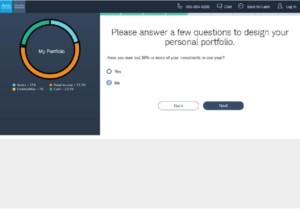

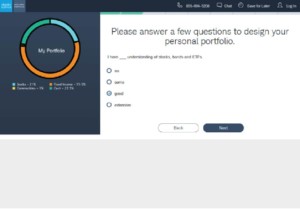

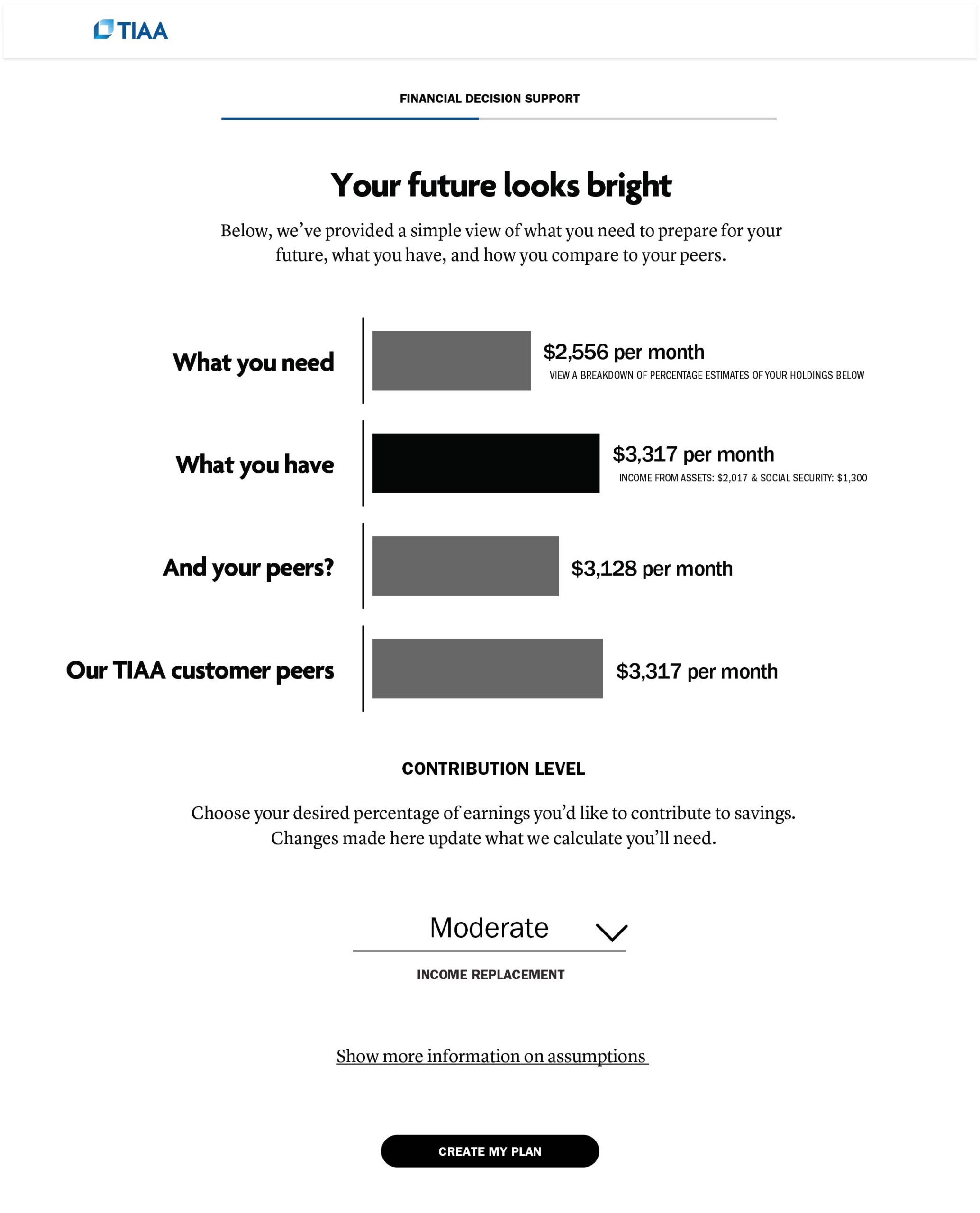

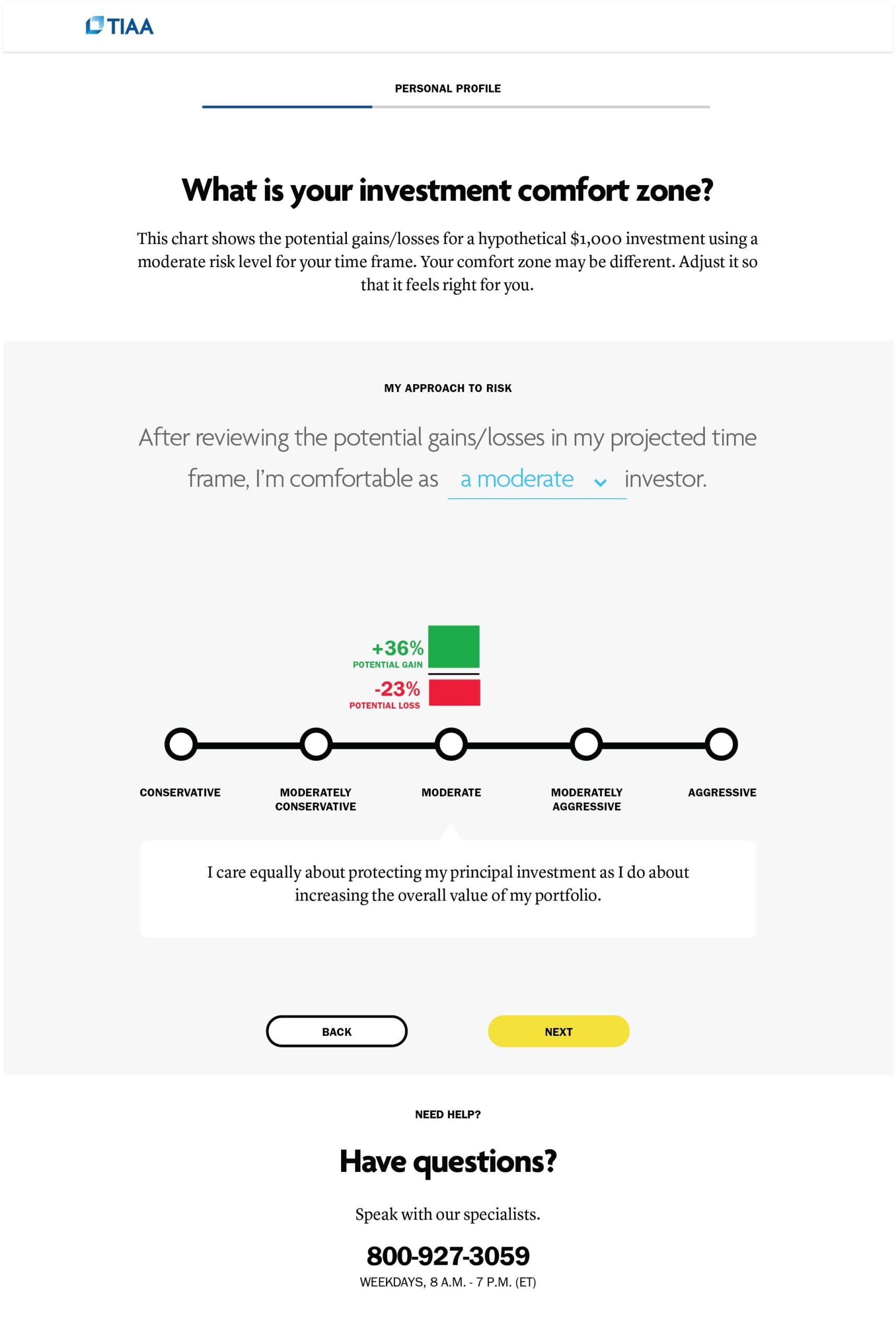

SIP incorporated simple questions to help users learn about risk and assess their risk appetite. Their results were also displayed in an engaging interactive dashboard.

EARLY CONCEPTS

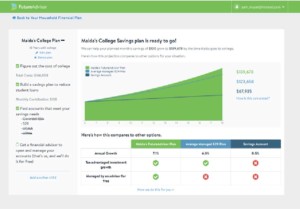

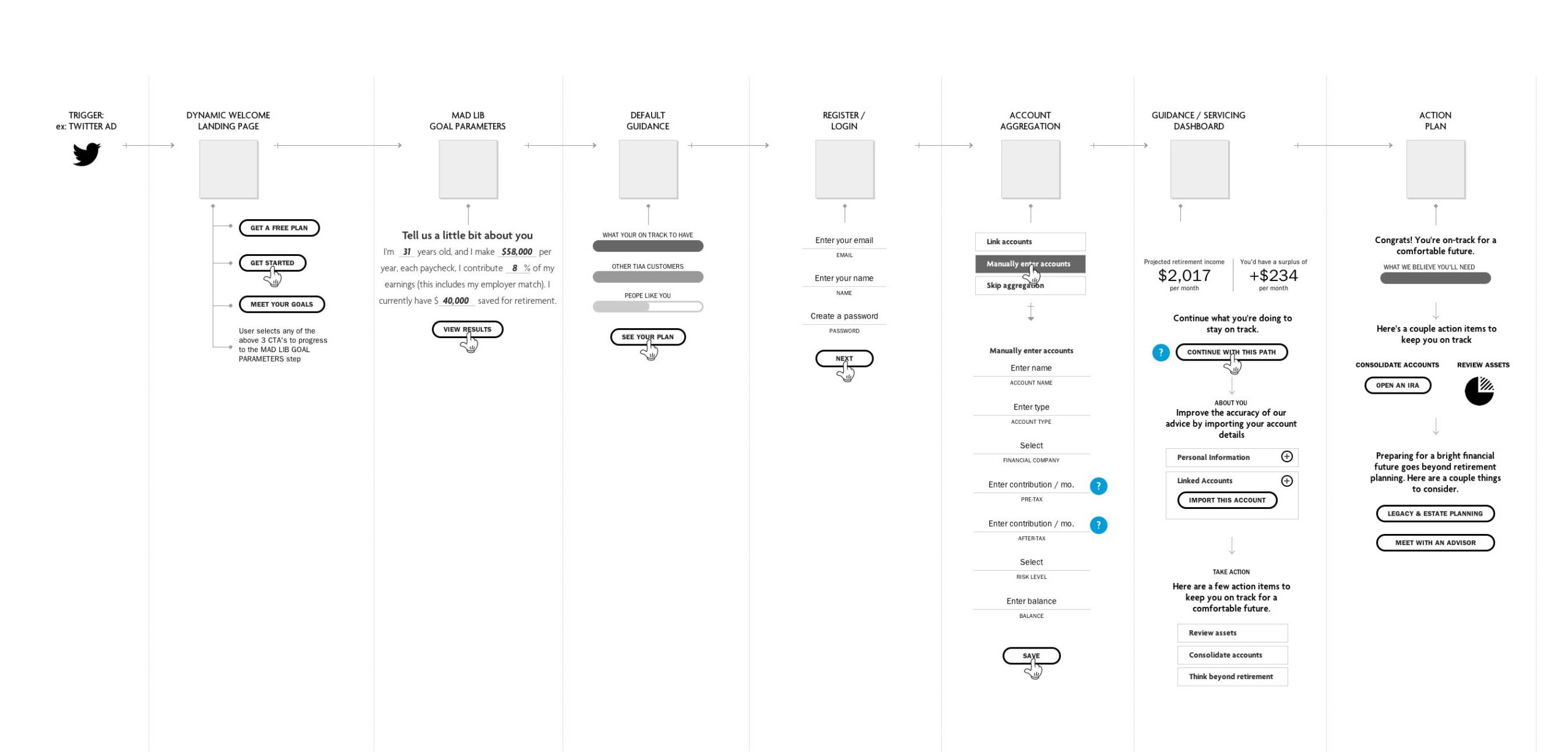

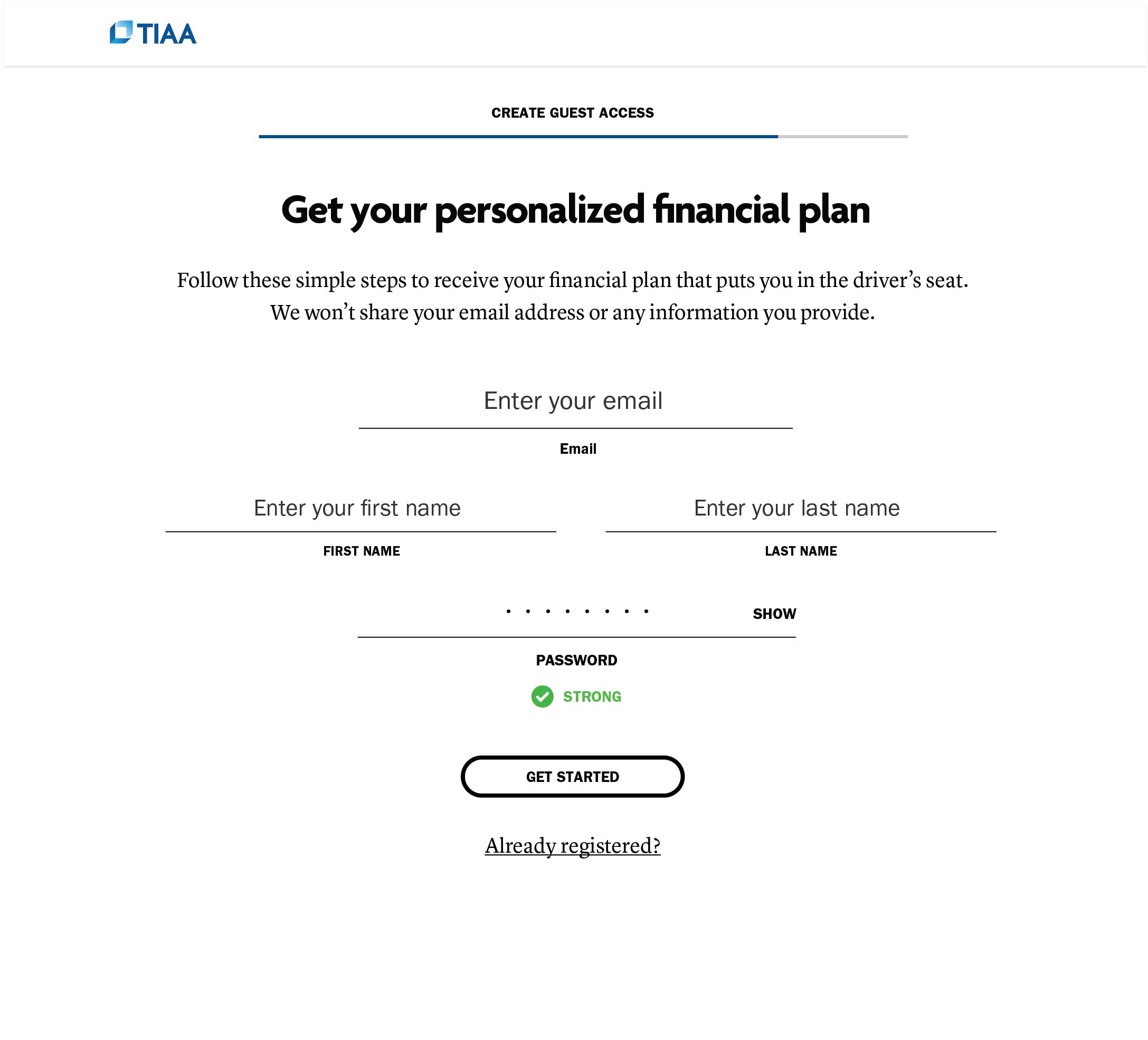

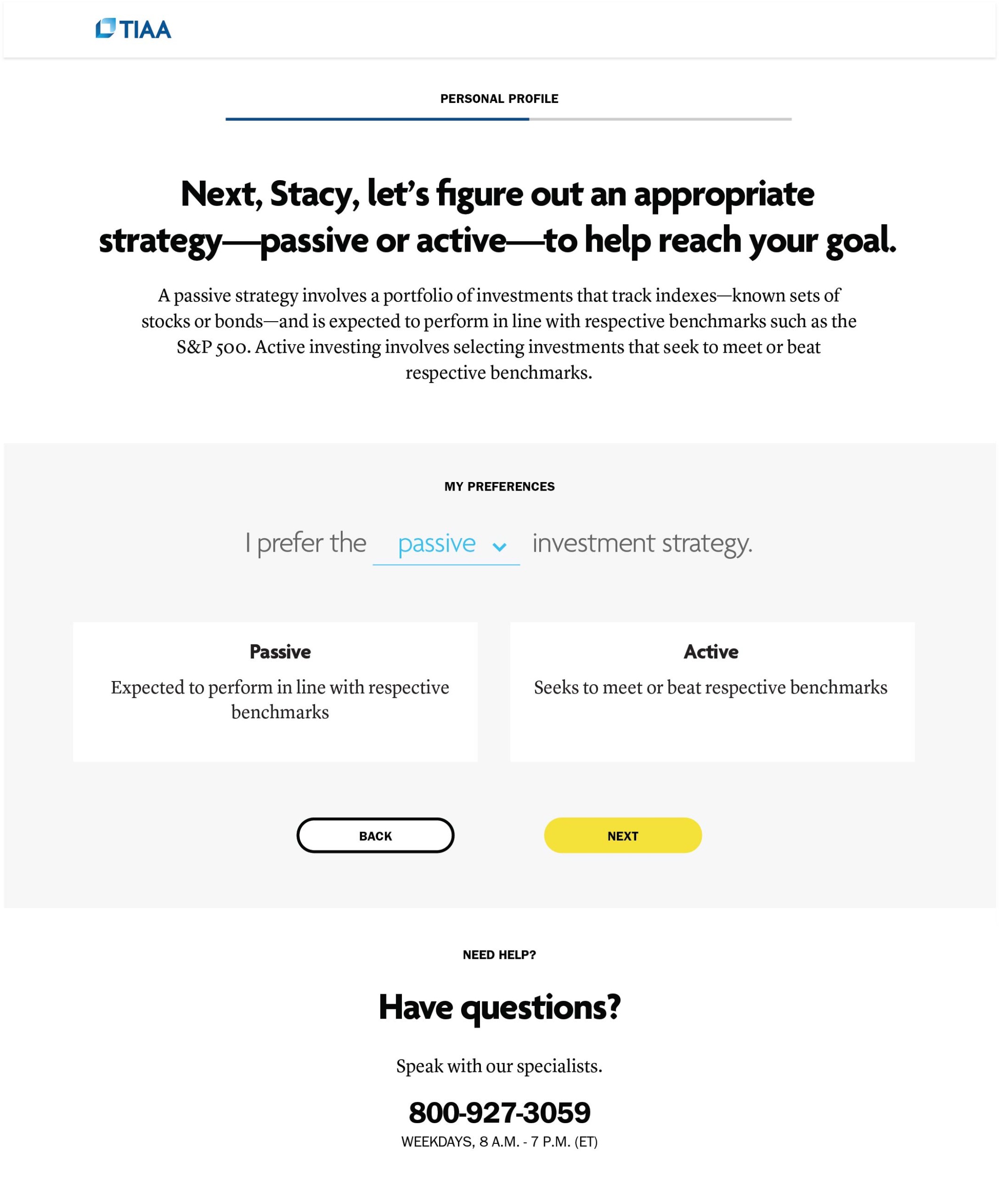

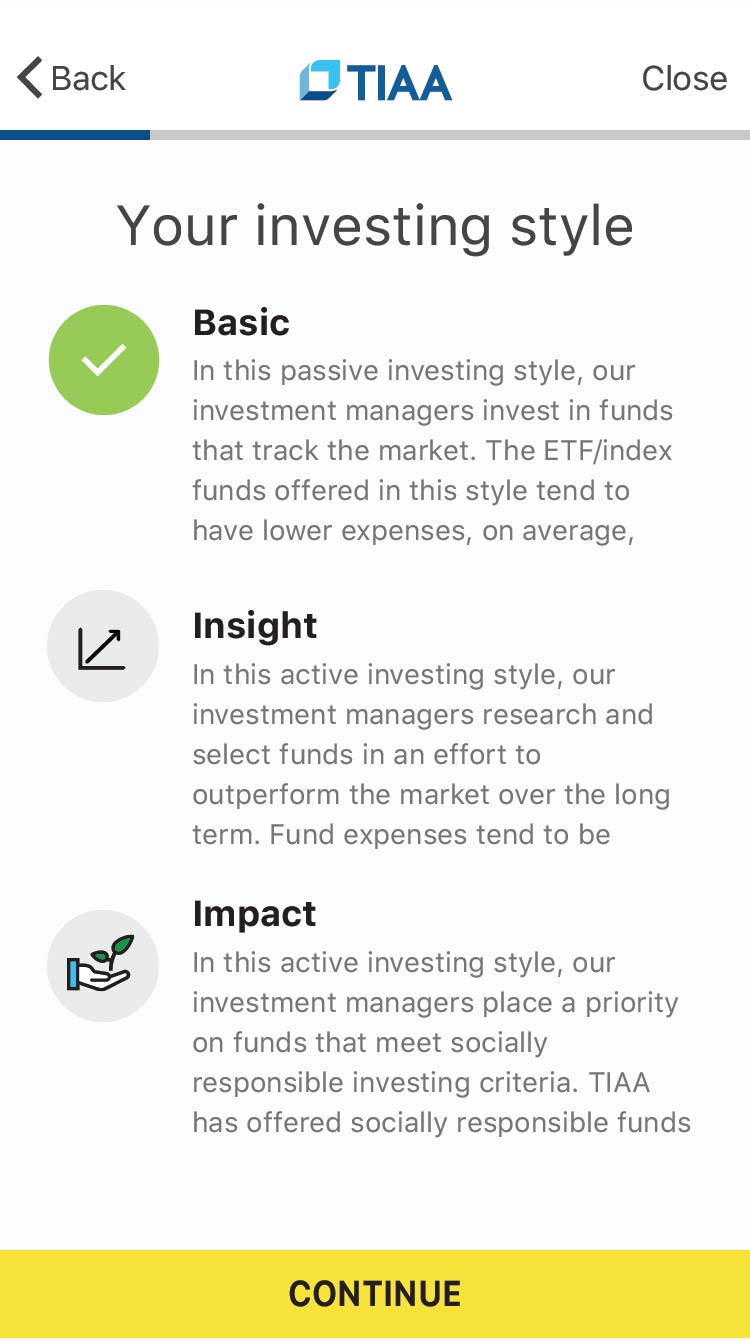

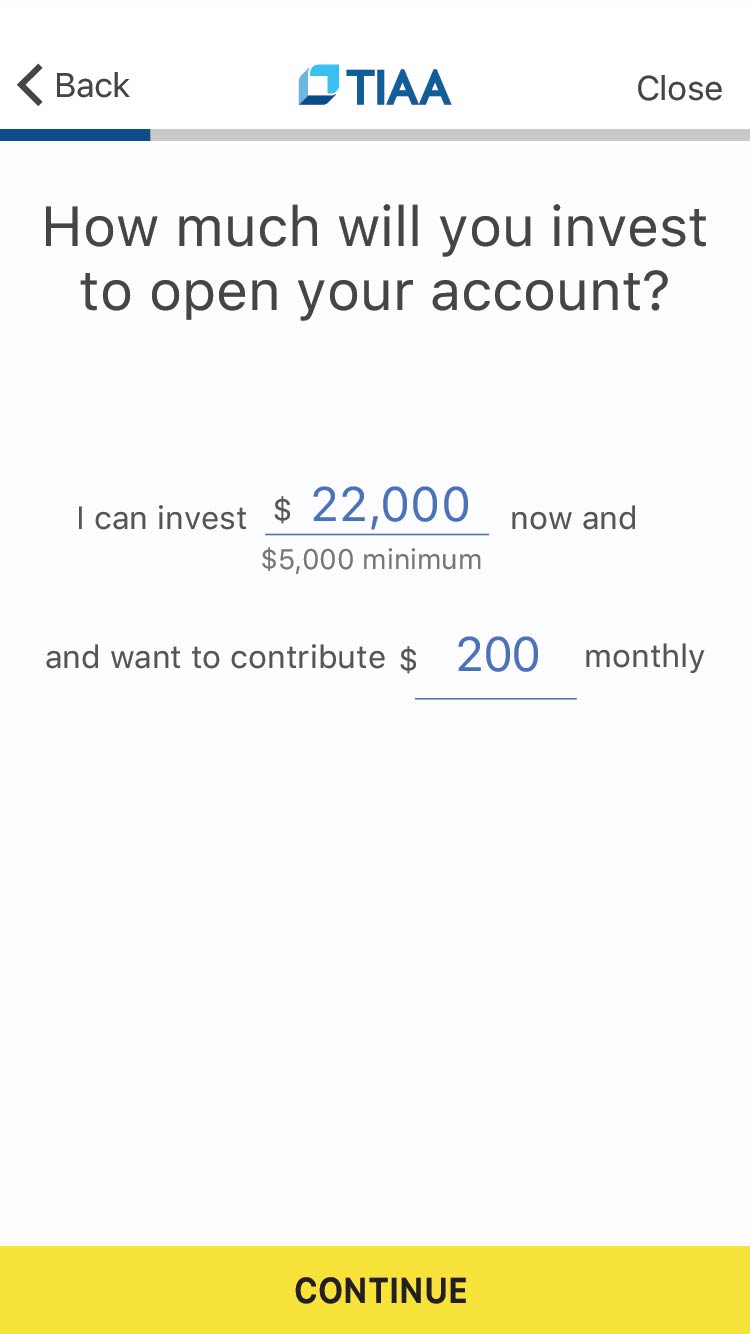

After defining the problem and researching how our competitors have solved for similar problems, I started imagining the various components of the experience. A major design objective was to create an experience that converts prospects to customers, because business priority was to target new business from millennials. This influenced the decision to separated then experience into two components, a Freemium and Premium experience.

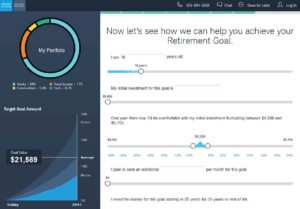

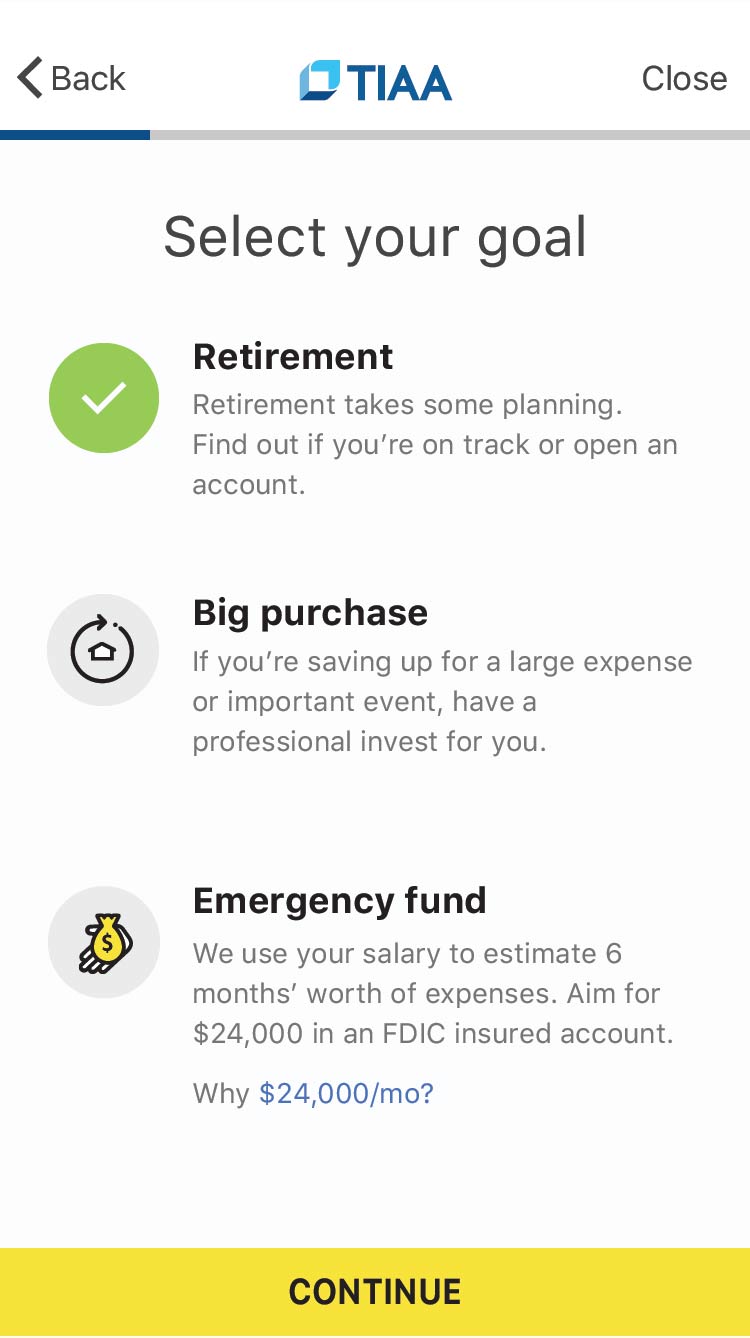

The Freemium component of the experience was designed to quickly introduce prospective customers to the value of a this managed account without having to answer some of the tough questions. It gathered just enough data to quickly test a prospect’s plan to achieve their financial goal while offering general advice. Prospects were required to register for online access to enter the Premium component of the experience. This part of the experience offered in-depth personalized advice on their existing accounts as well as possible outcomes for new accounts. Existing customers always received the enhanced Premium experience.

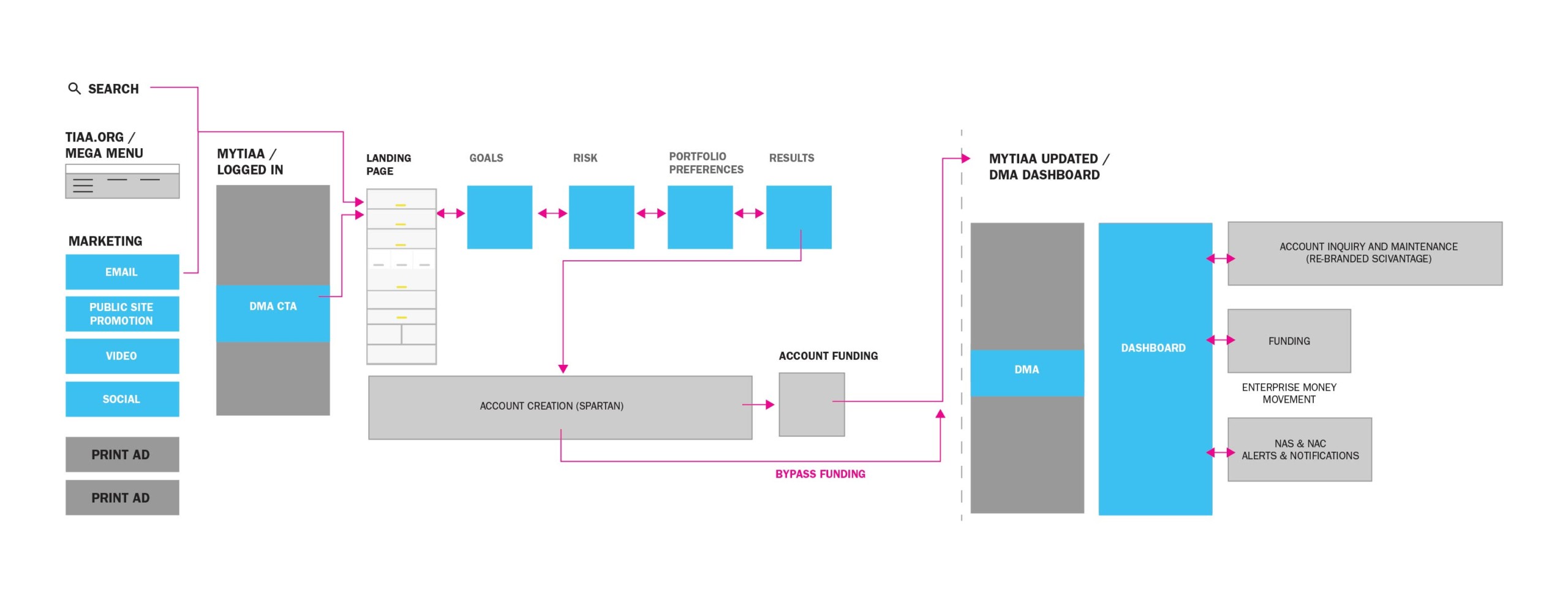

HIGH LEVEL FLOW DIAGRAM

EXAMPLE SPECIFIC USER SCENARIO

FREEMIUM WIRES

LATER ITERATIONS

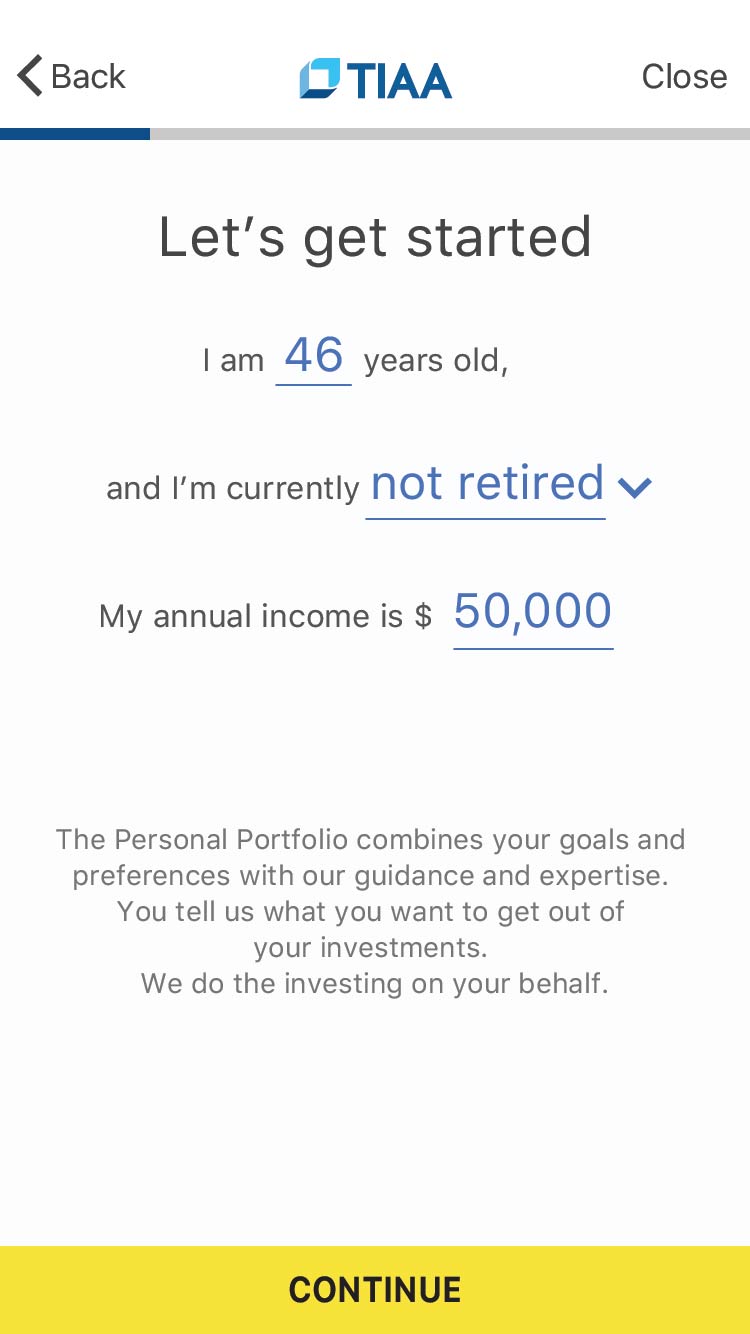

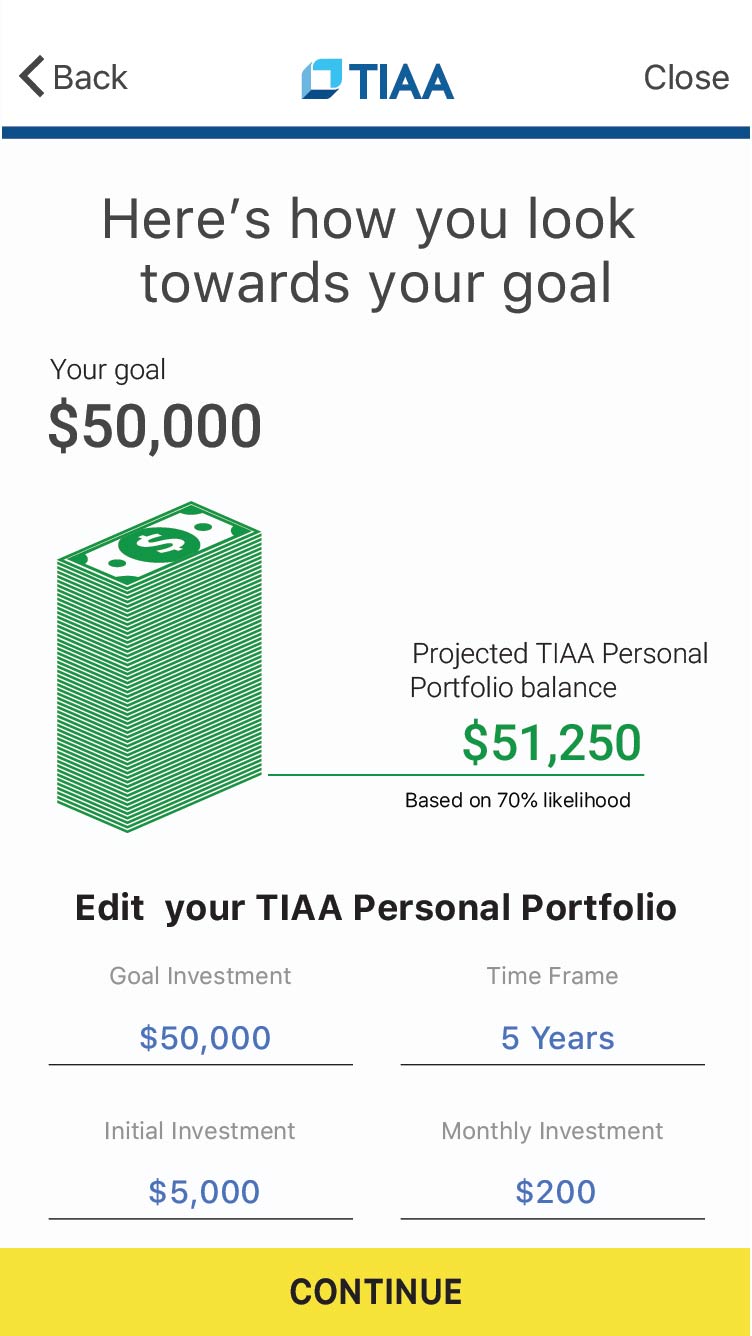

After designing the major cases, we tested early concepts with several prospective and existing customers. Among many findings, we learned that the freemium experience didn’t provide enough value to convince the user to provide their personal information before moving forward into the premium experience. So in later iterations, we decided to remove this barrier to entry. Instead of an abbreviated experience for prospects, an enhanced experience was offered to both existing customers and prospects.

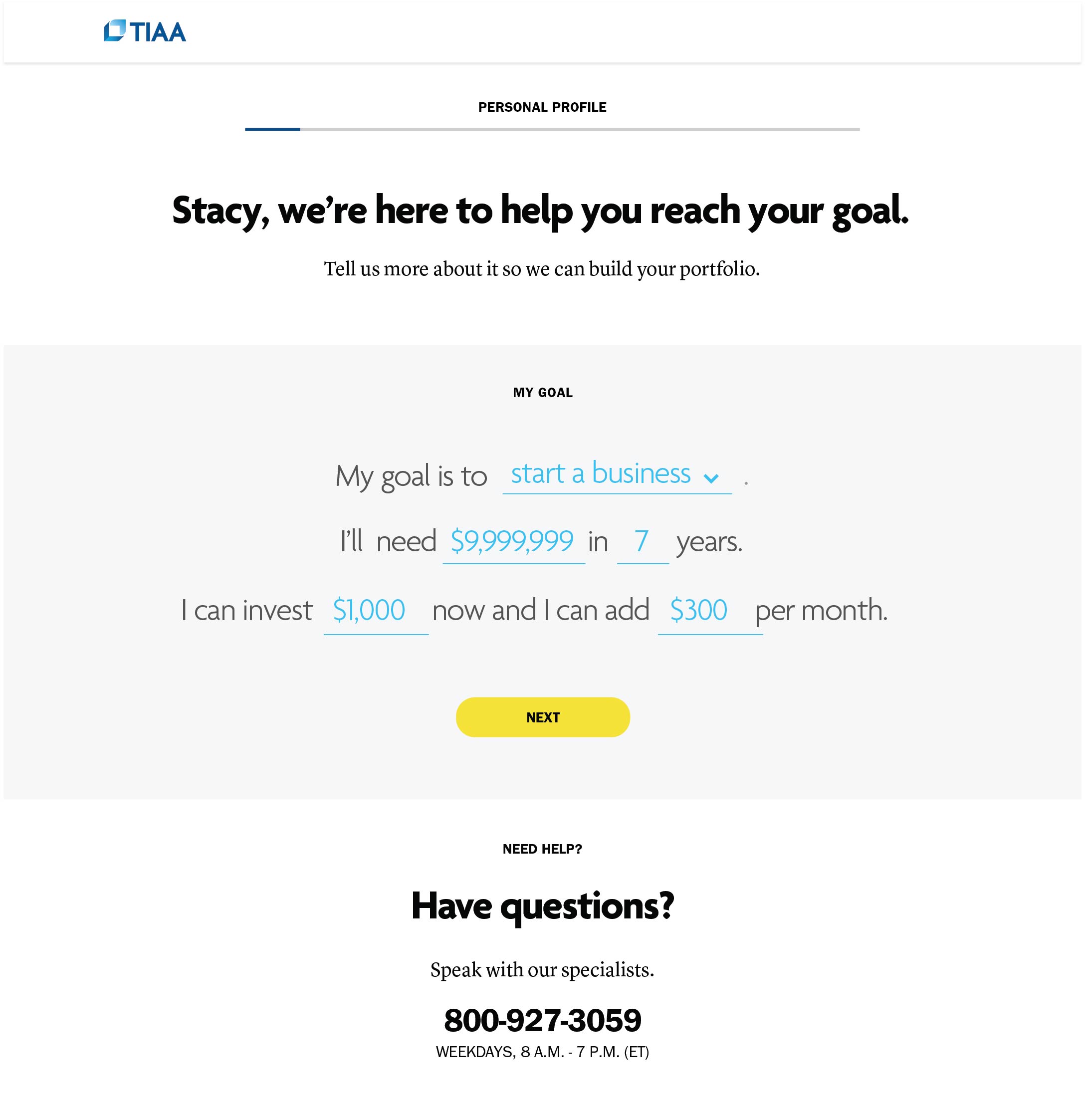

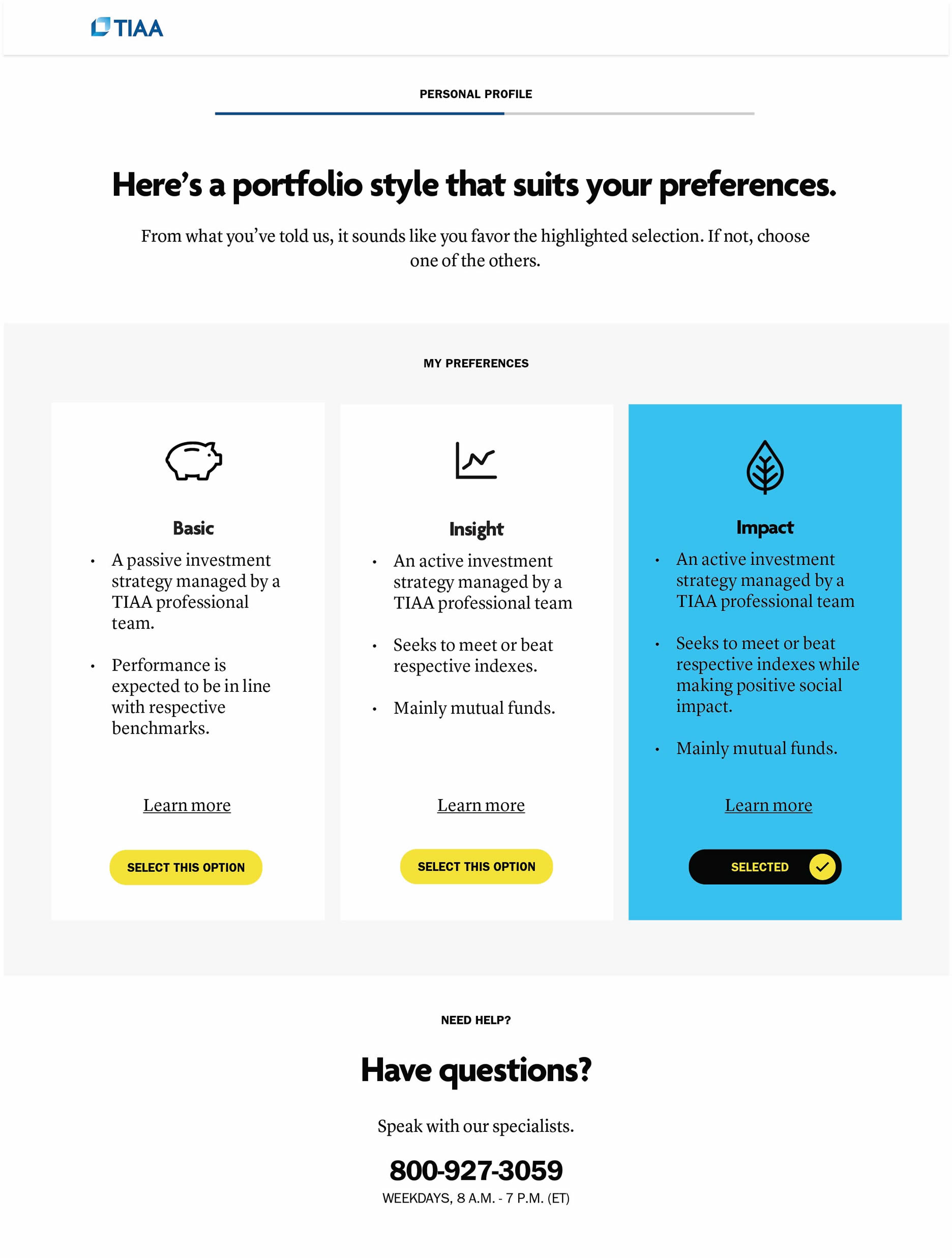

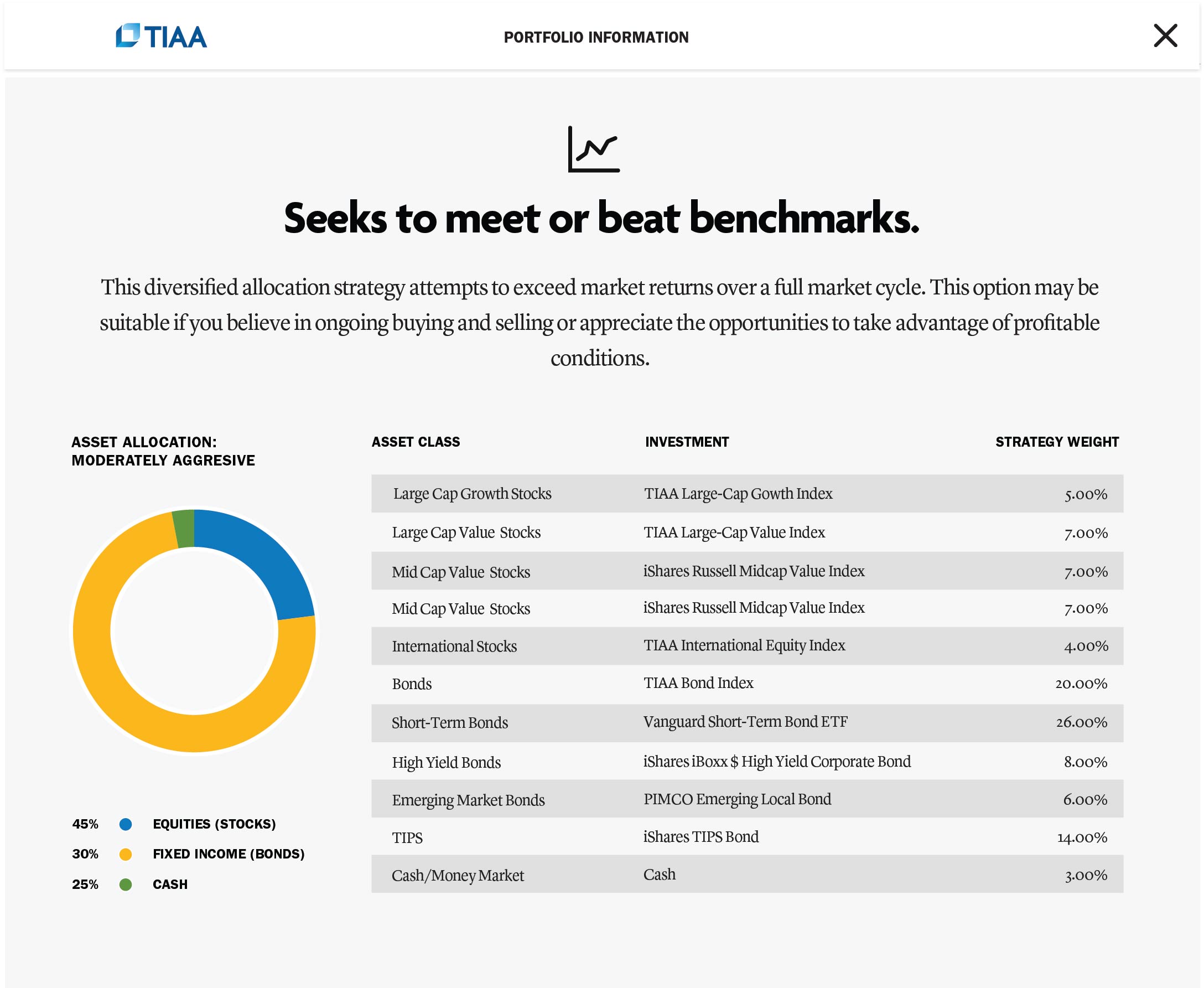

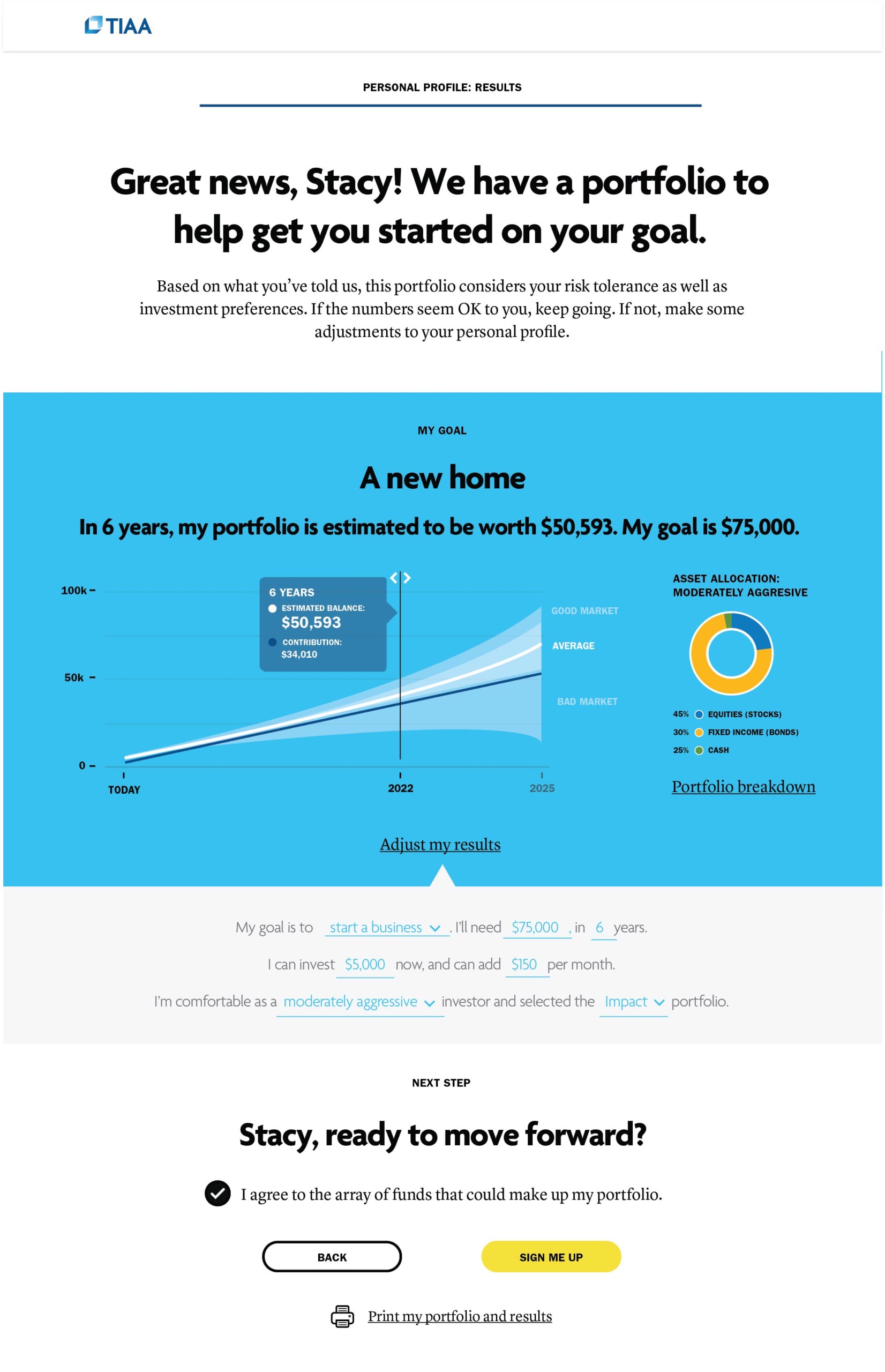

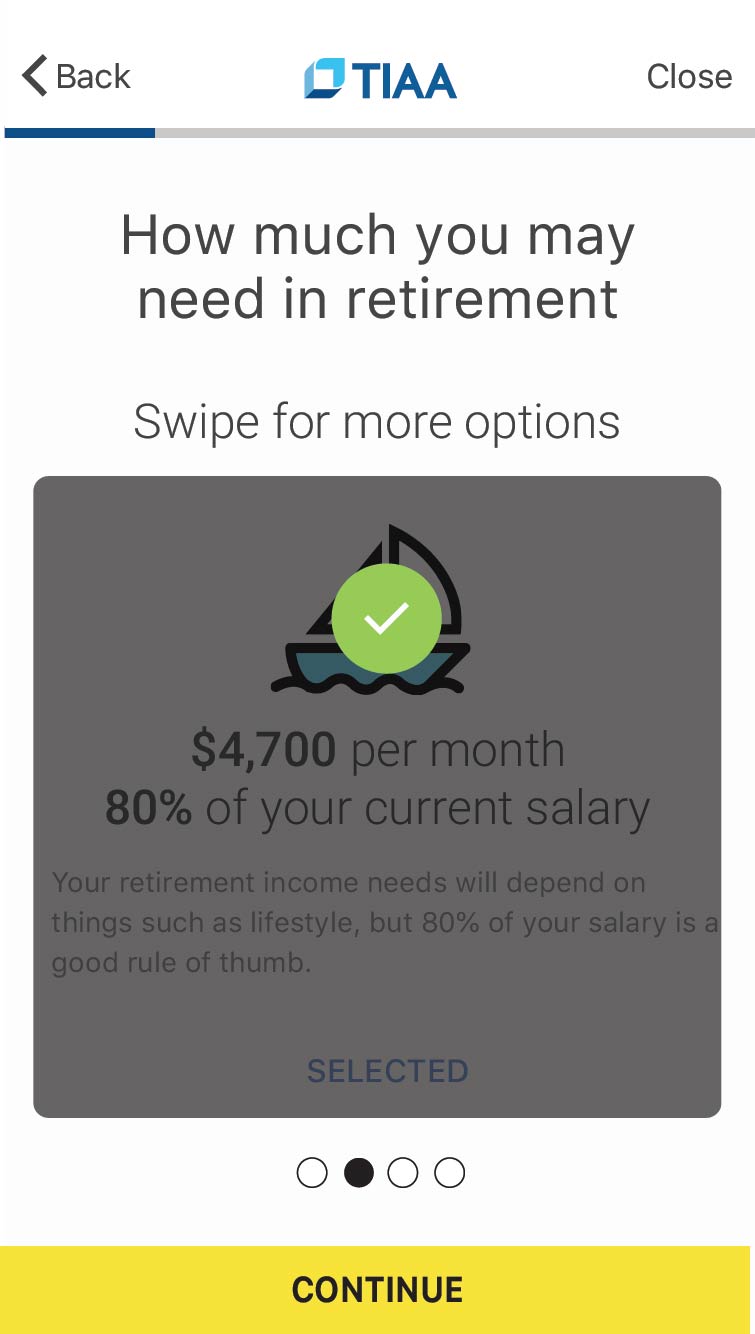

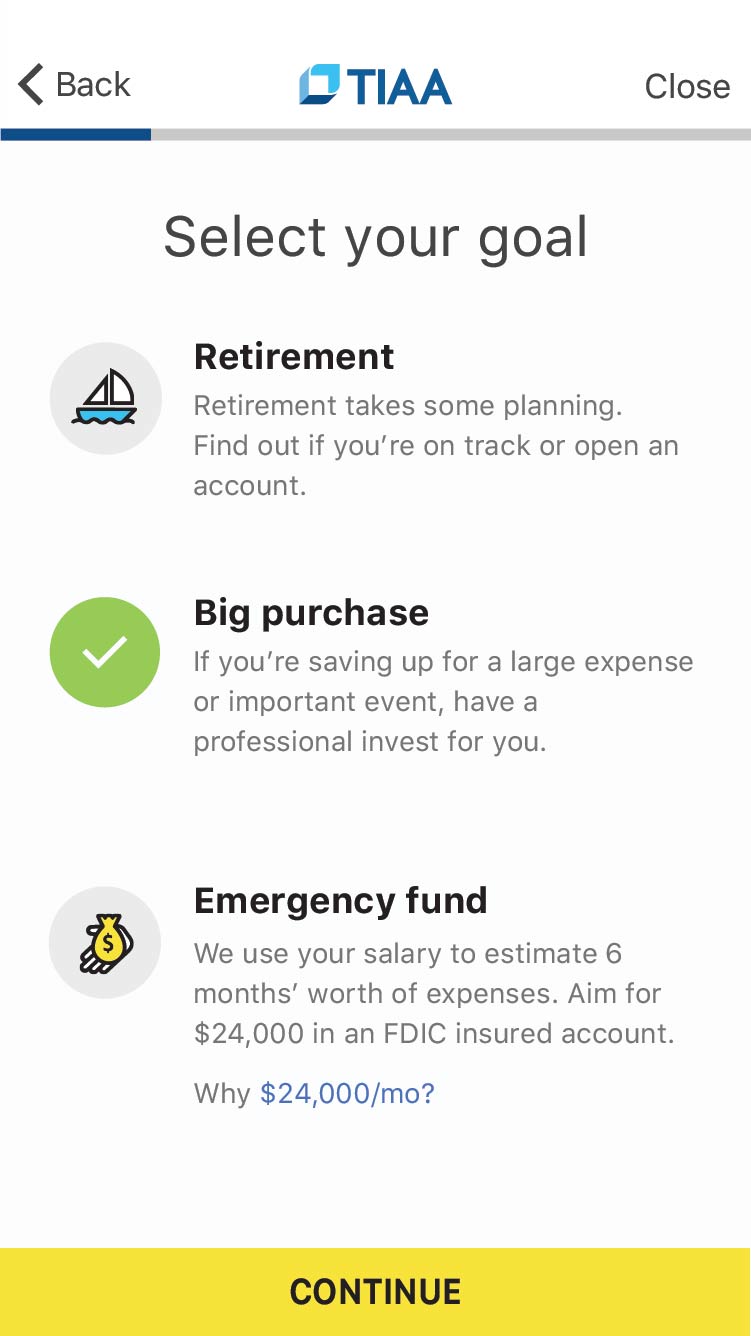

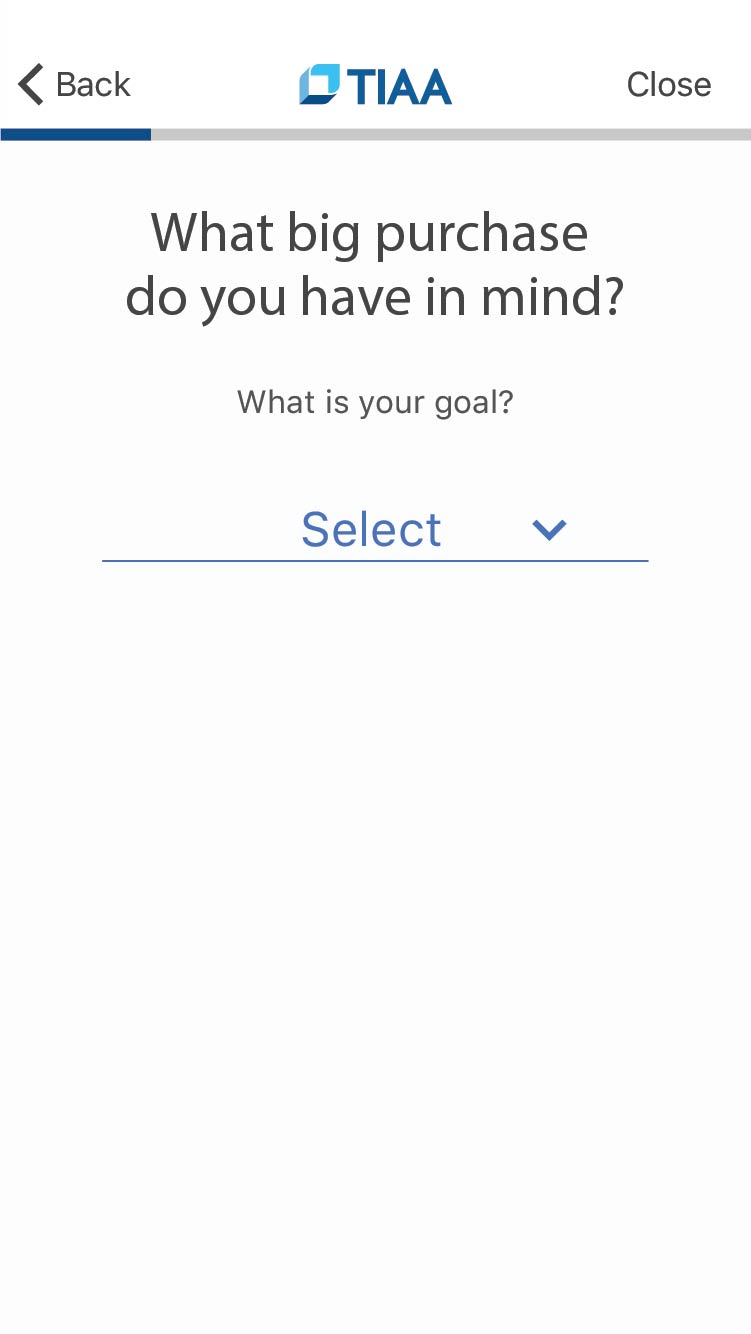

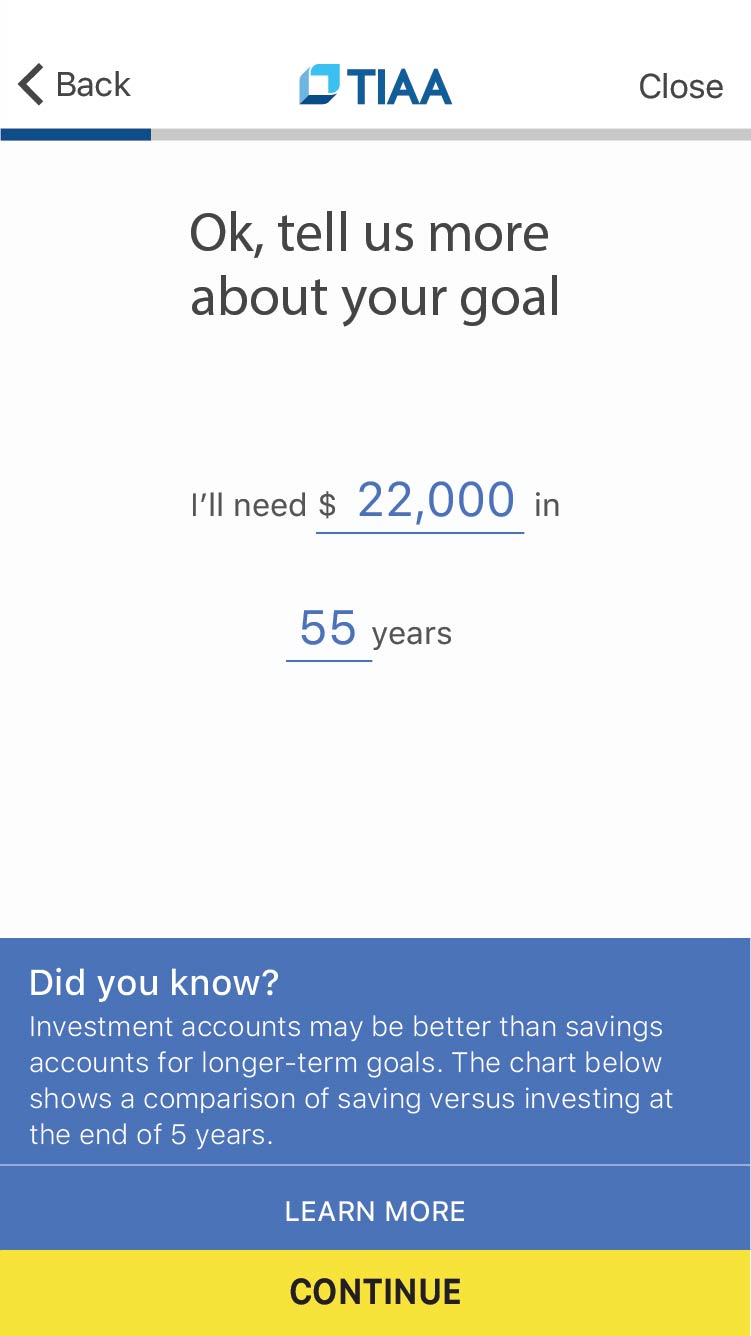

GOAL BASED INVESTING

CONTINUOUS IMPROVEMENT

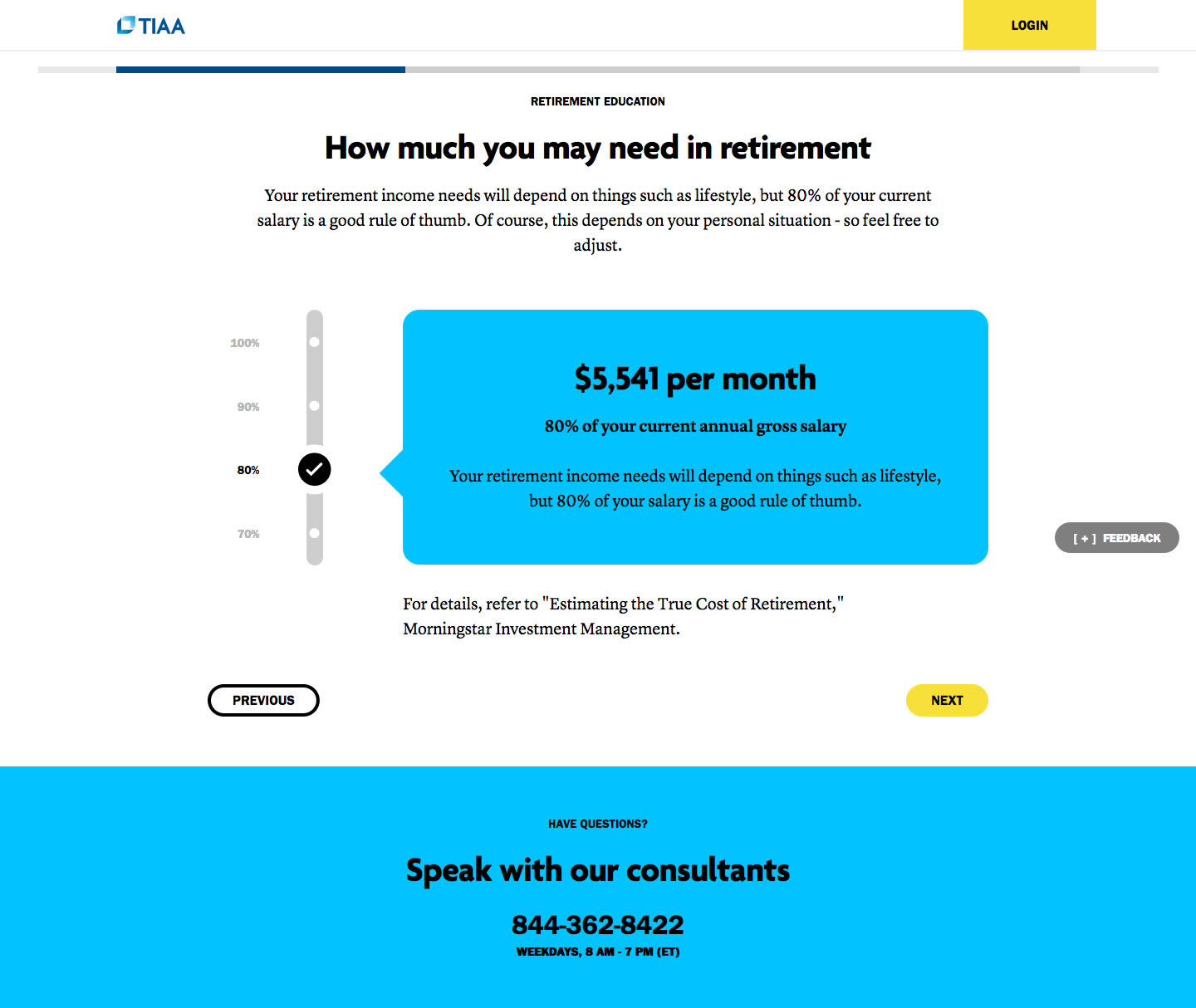

Removing the barrier to entry and offering an enhanced experience to all customers tested very well. As we continued to test between design iterations, our research discovered several other opportunities to improve the experience, like:

Existing brand components and styles were creating a false bottom

So we reduced the size of the headers, reduced some vertical spacing, and used more horizontal space.

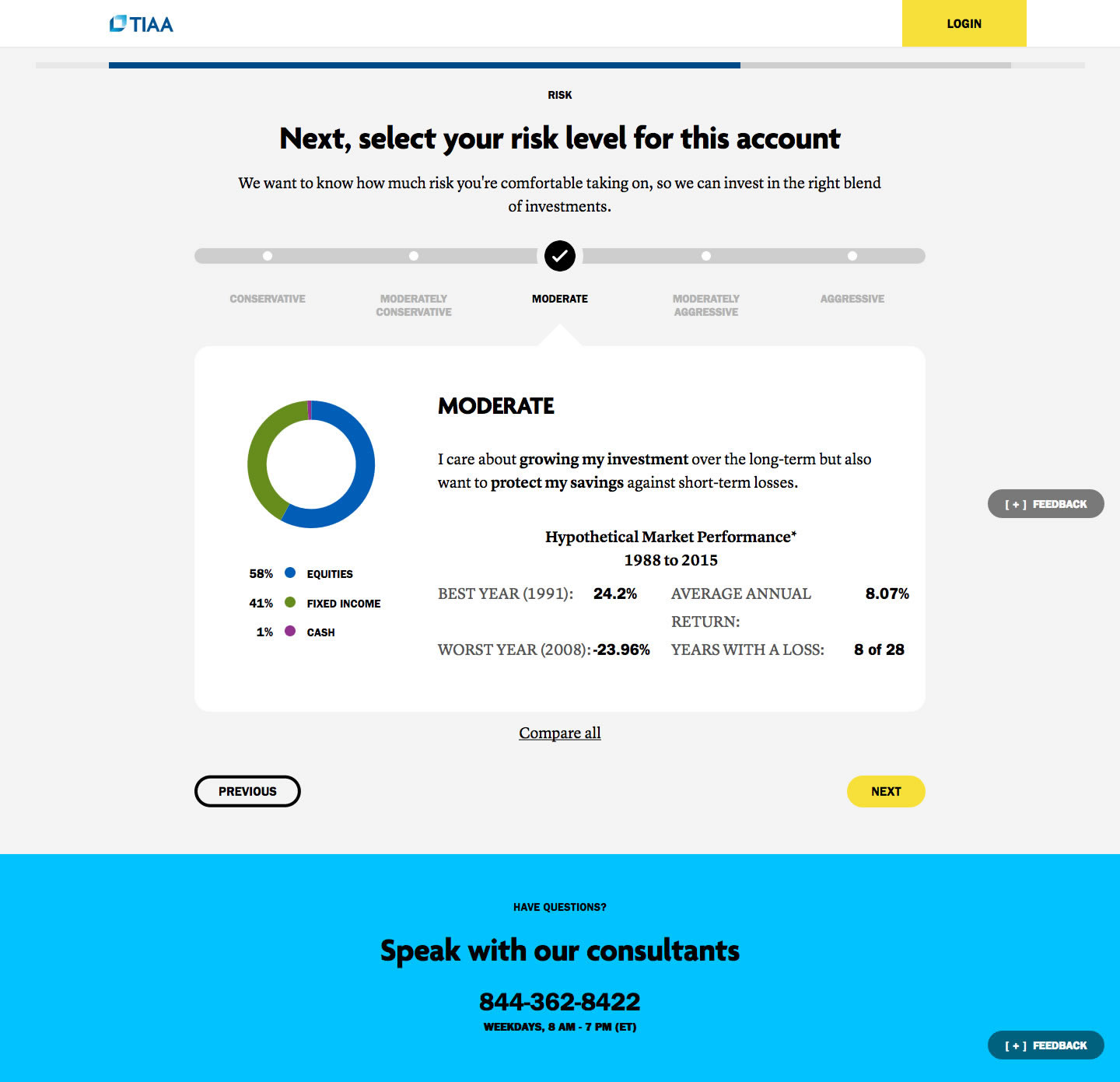

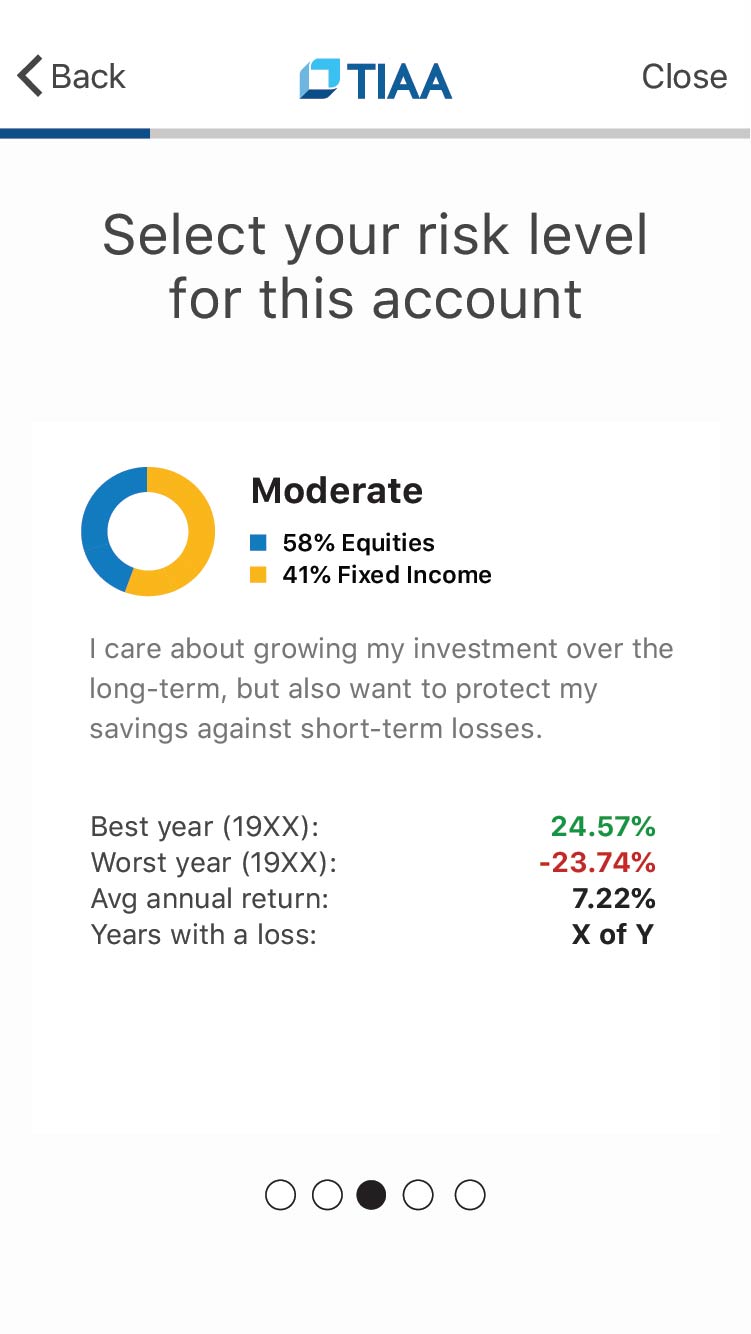

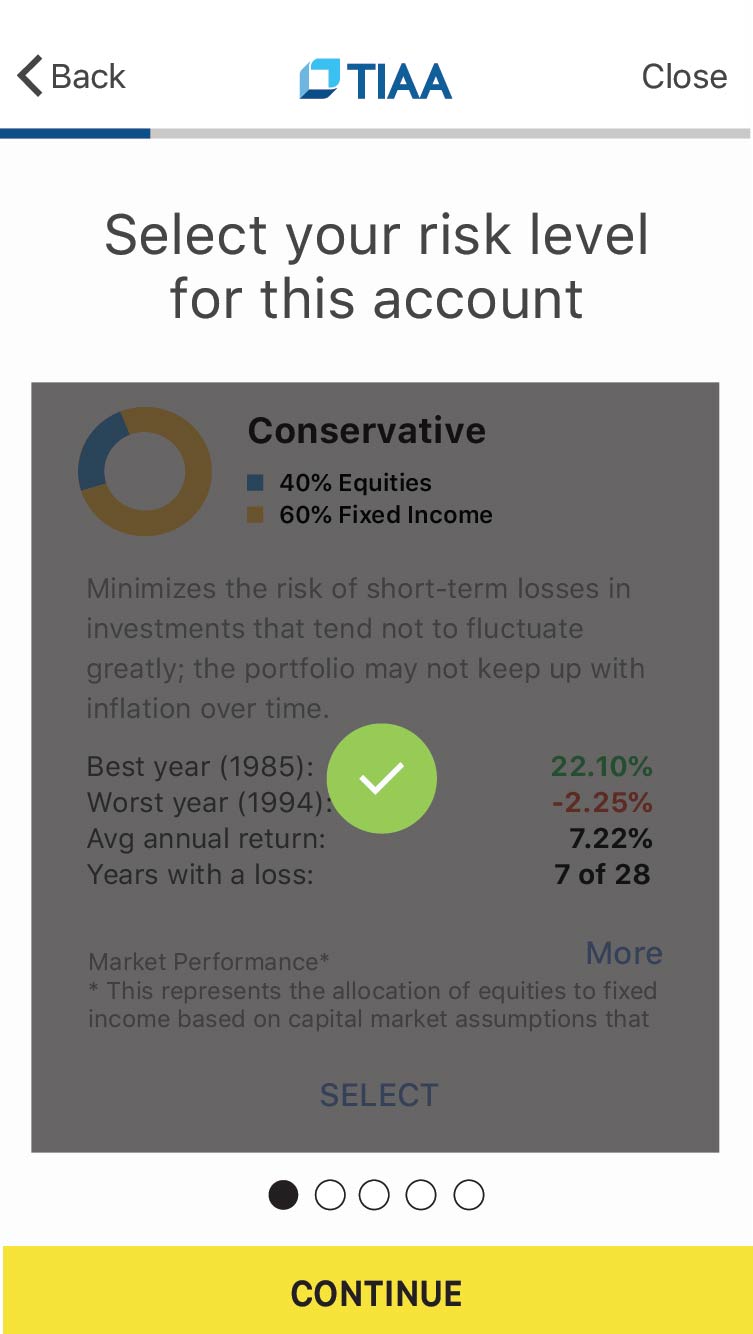

User’s found it difficult to understand the risk vs reward comparison of the various investment tolerance levels.

After providing the best / worst years and other data, users were able to recall their lives during that time which helped them understand the different levels of risk.

FIT, FINISH, & MEASURE

Even though design is never done, it was time it wrap up and go to market with the latest experience. The last piece to the puzzle was to translate the designs into mobile styles/patterns, collaborate with branding on tweaks to existing styles, and align with marketing to ensure landing pages and other content complimented their strategy.

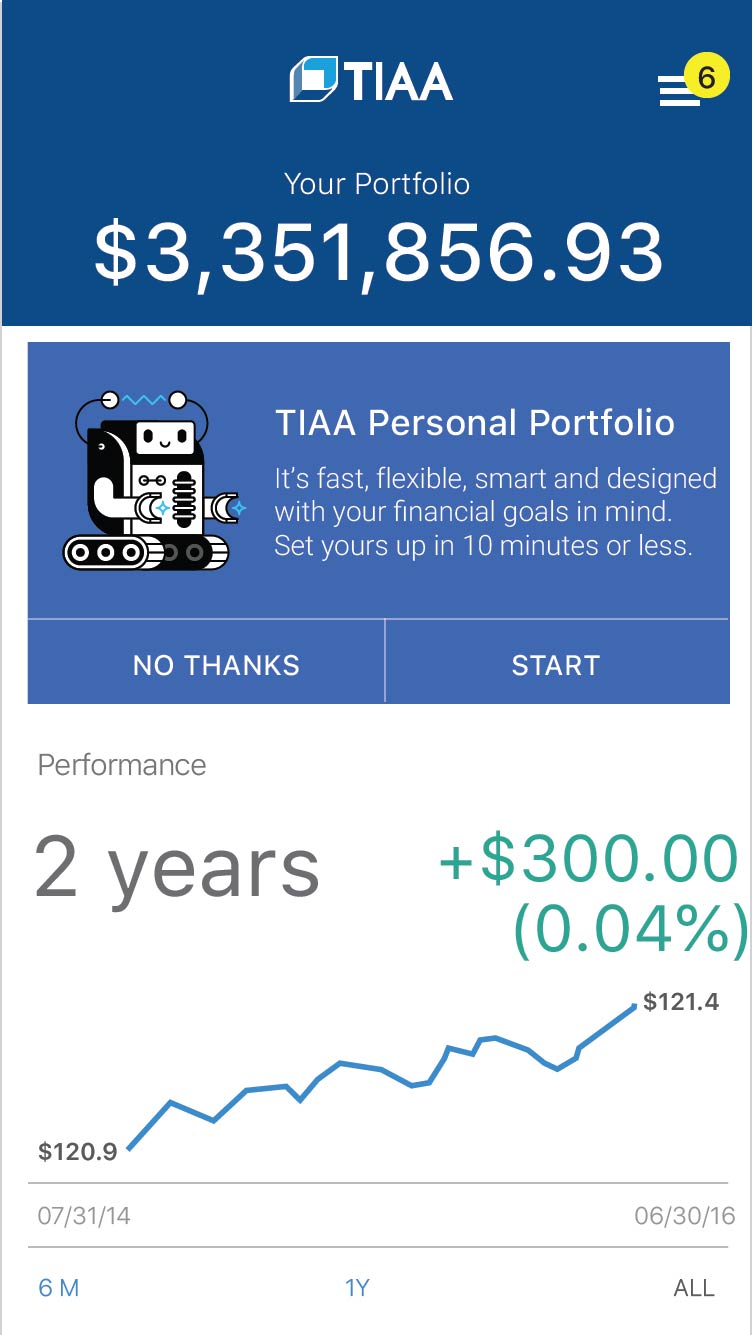

MOBILE APP DESIGNS

SUCCESS METRICS

At the release of this new product, a low cost managed account, the initial experience was broken of 3 segments, product awareness, engagement thru goal creation, and account opening. Metrics showed that the complete experience, from landing page to an opened account, conversion rate was 5.37%.

This new low cost managed account introduce many prospects to TIAA’s product offering beyond retirement products. By doing so it attracted new customers and retained out flowing assets from existing customers. The project was successful in generating ~$13.31M in new assets under TIAA’s management between Jun 17 and Nov 17.