Digital Advisor

PROJECT DESCRIPTION

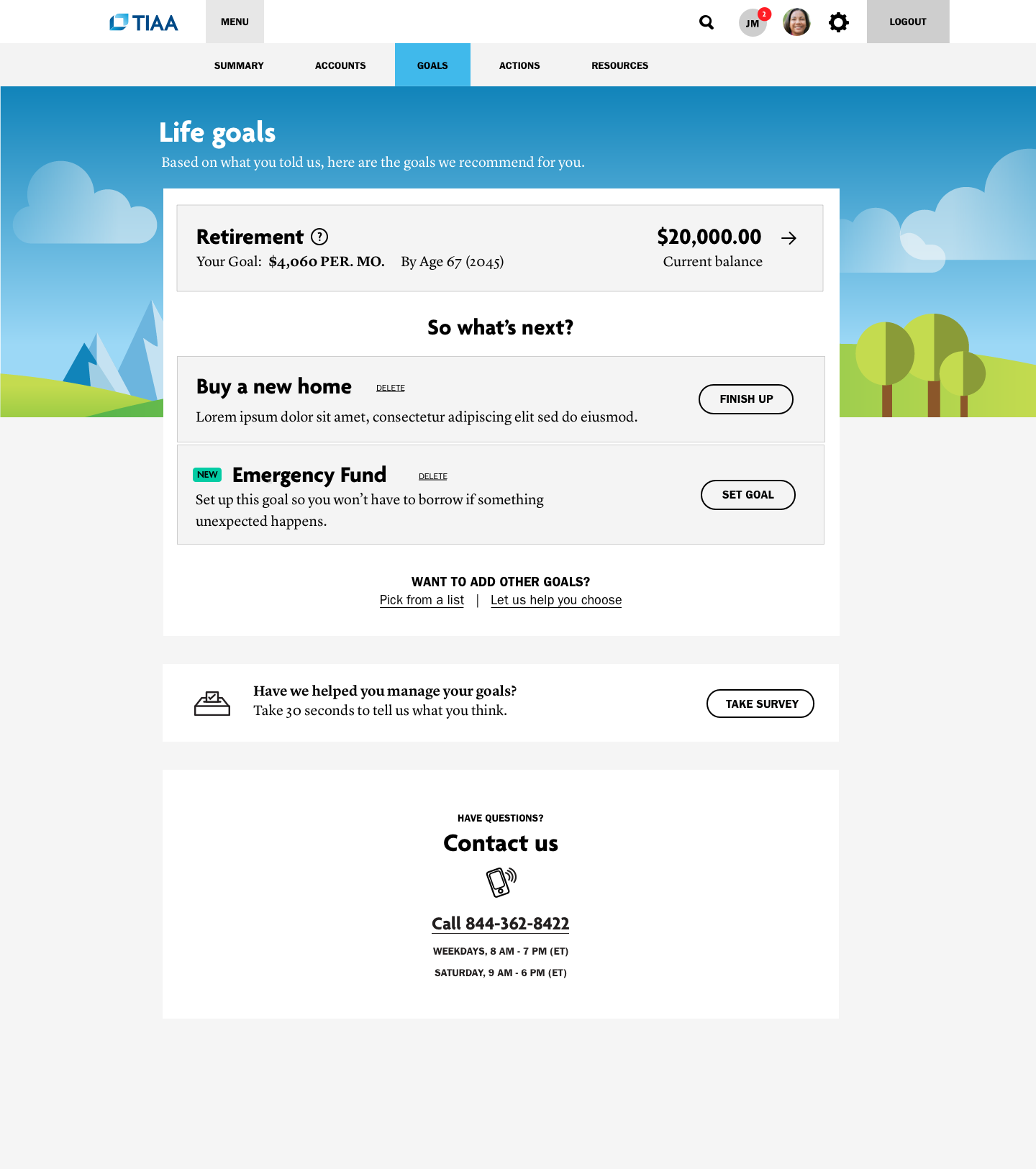

After launching TIAA Personal Portfolio (TPP) in 2017, an emphasis was placed on continuously improving the experience in 2018 by conducting a series of in-person interviews, A/B testing concepts, and analyzing other digital metrics. Our research led to several enhancements that evolved TPP into Digital Advisor. A major catalyst in this evolution was learning that seeking investment advice was low on the priority list for many of our customers.

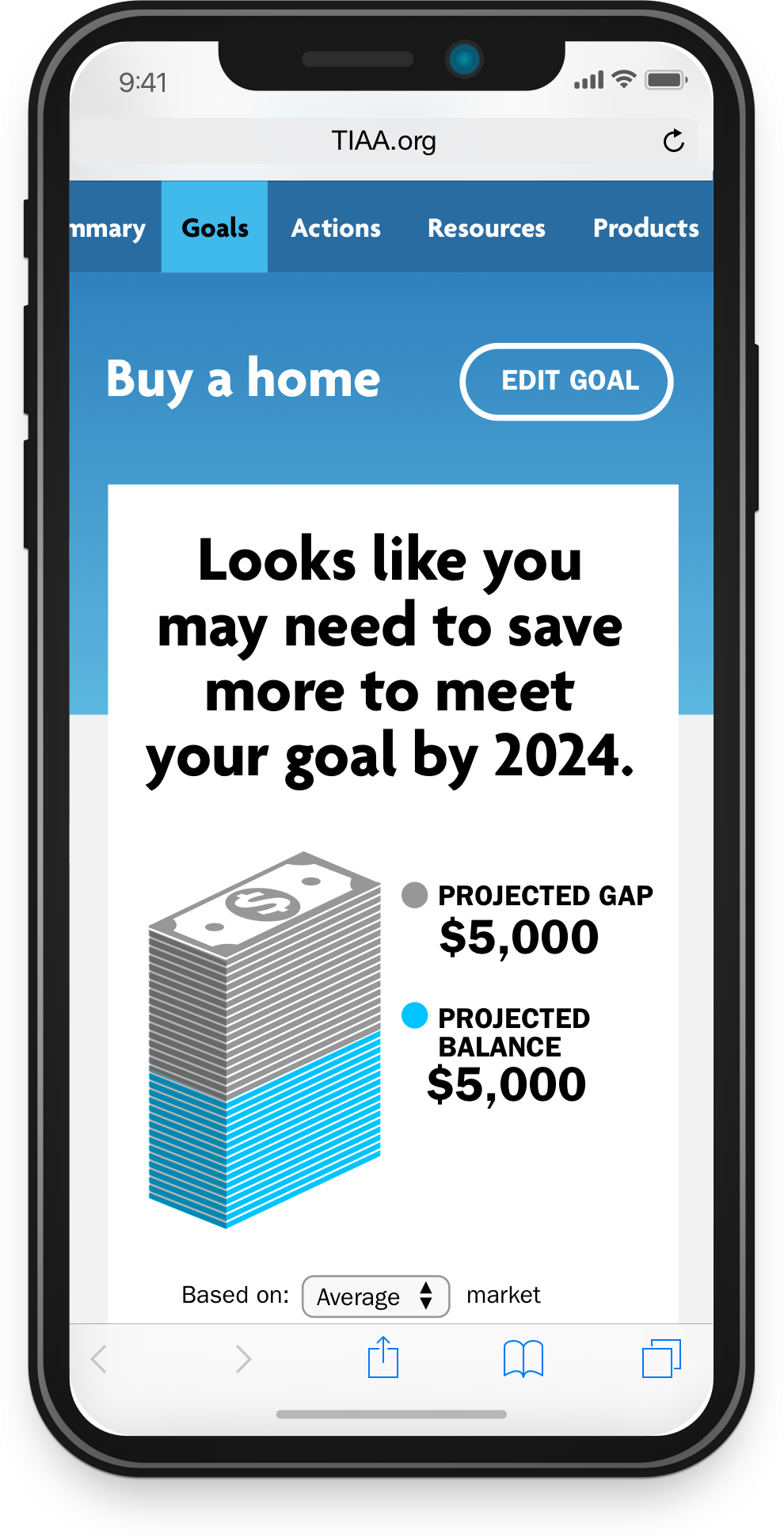

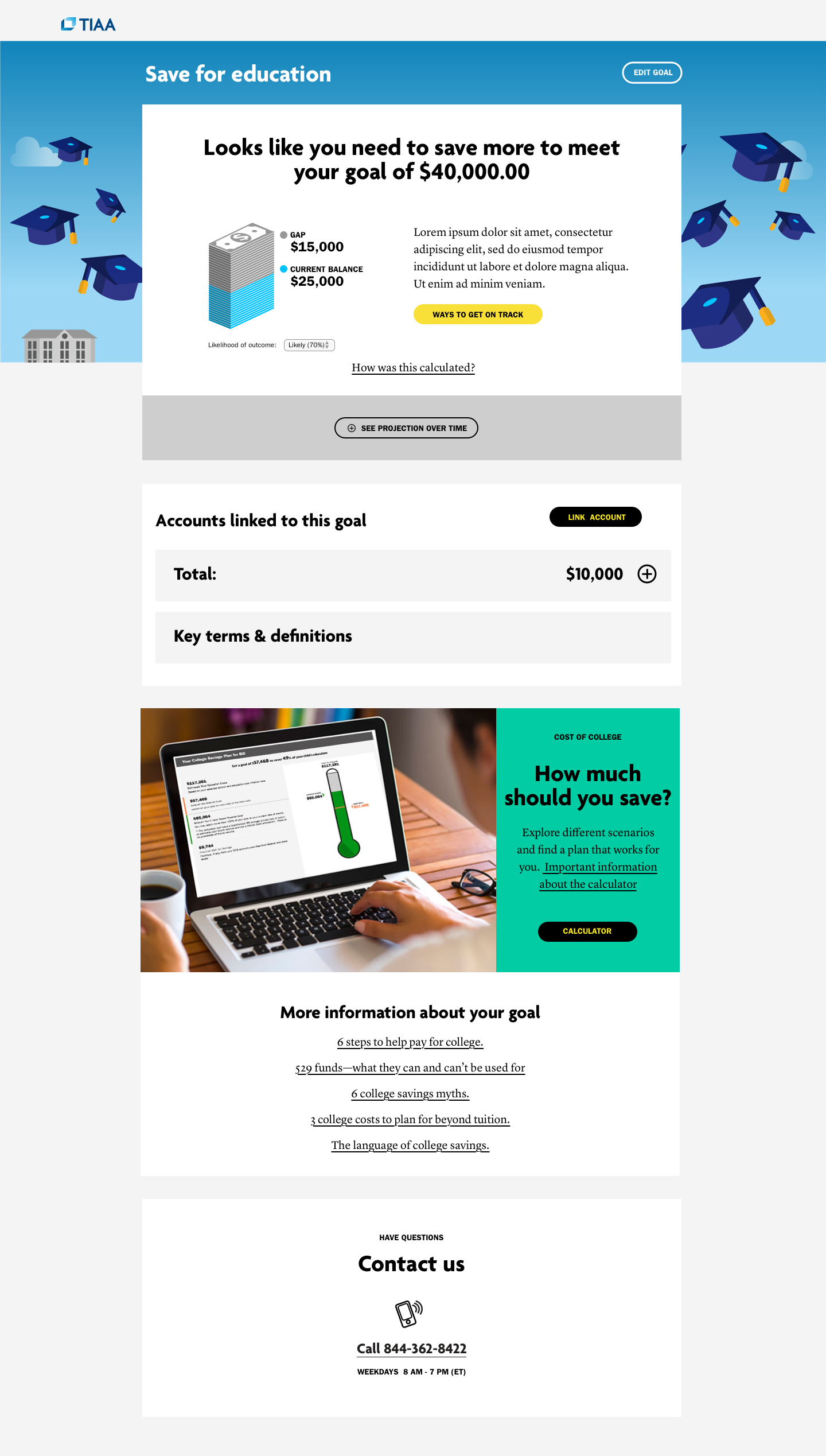

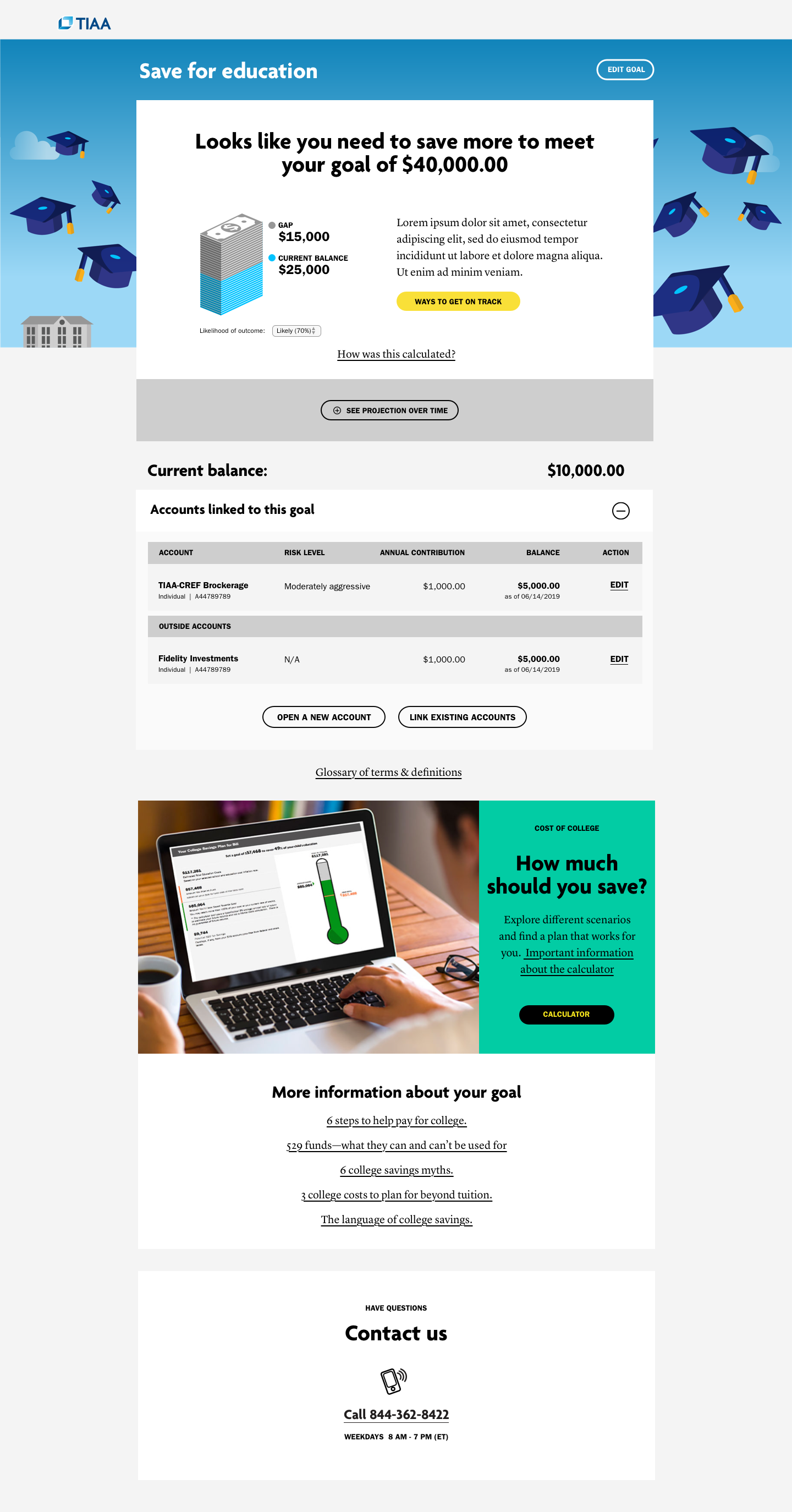

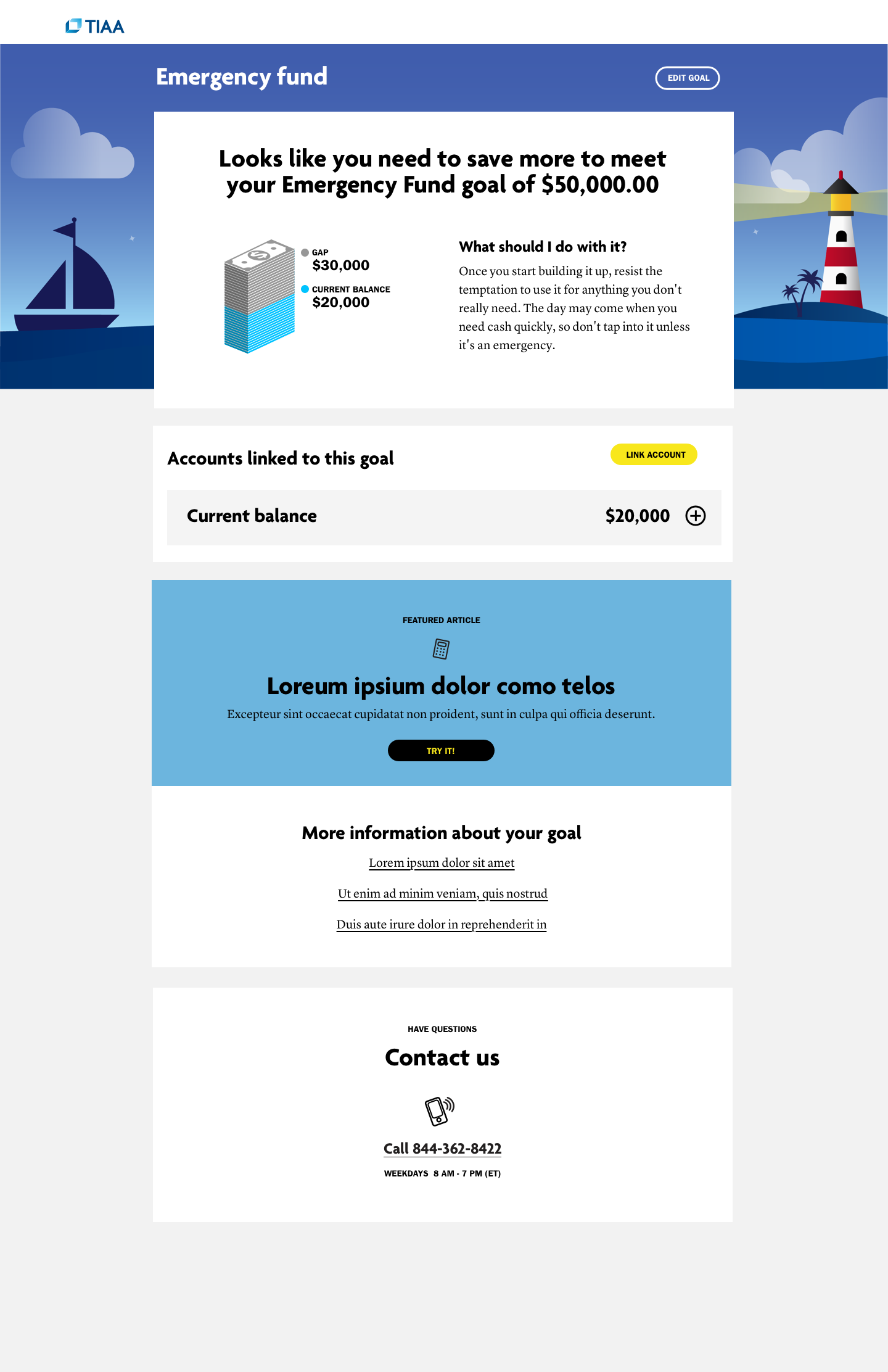

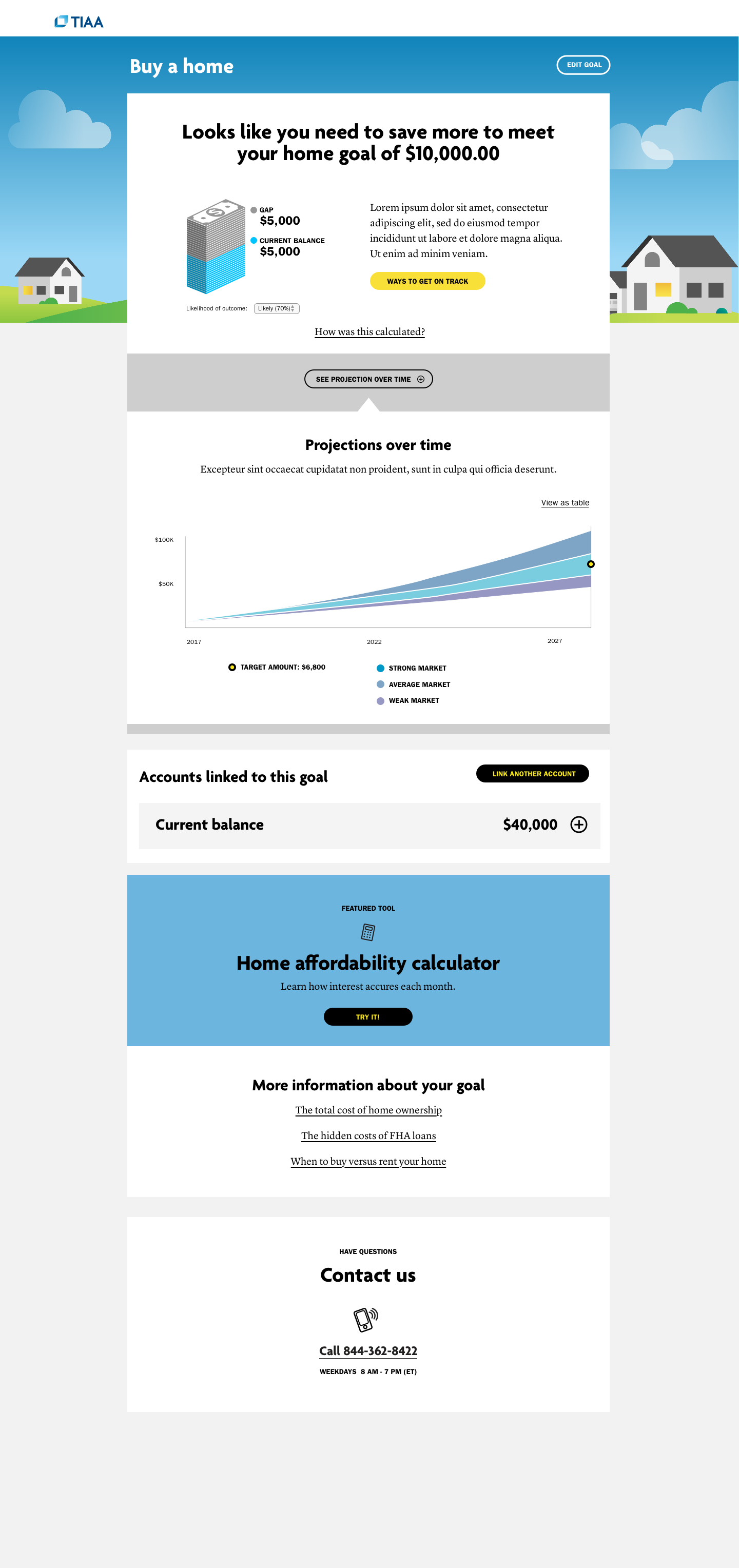

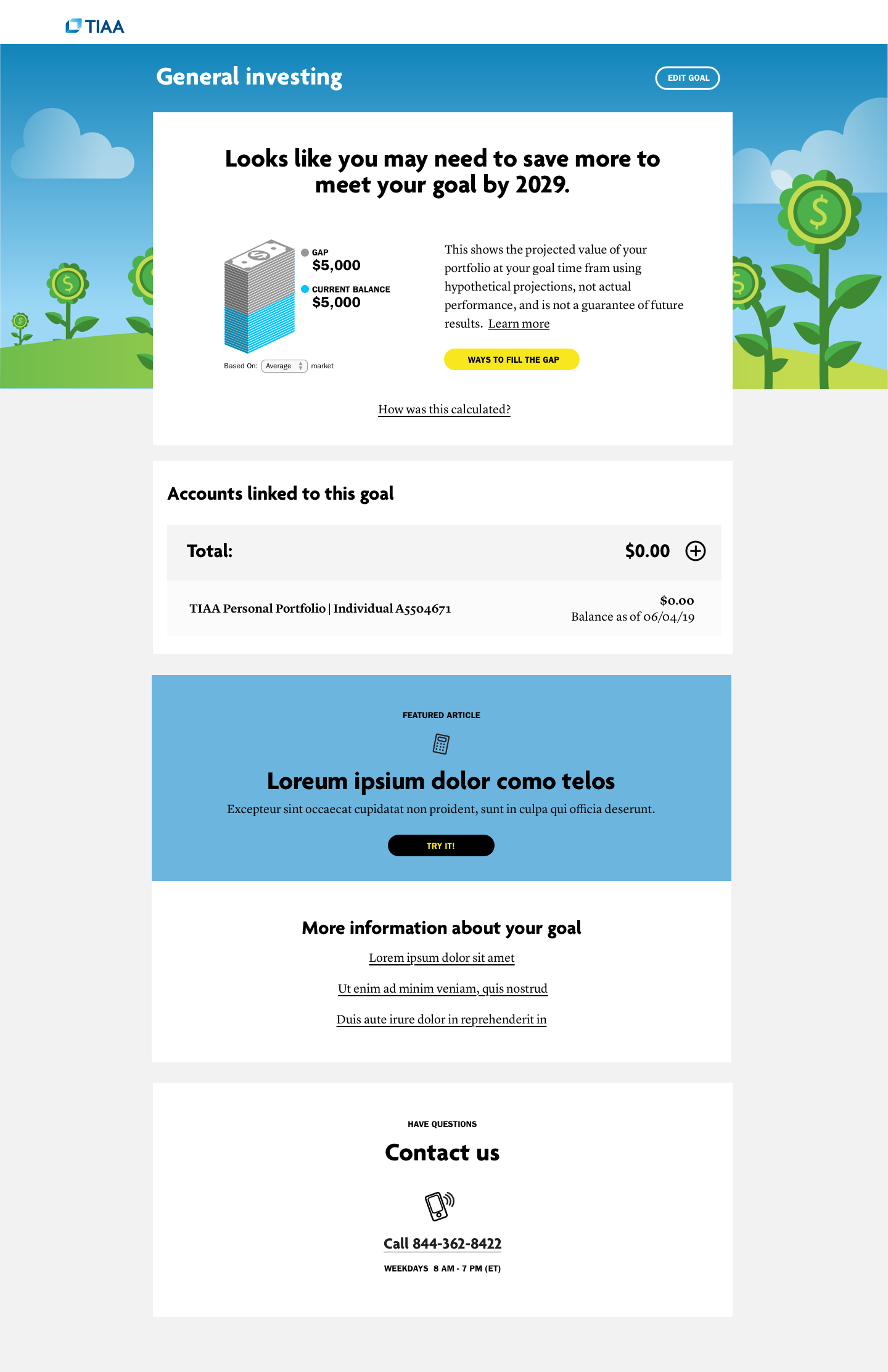

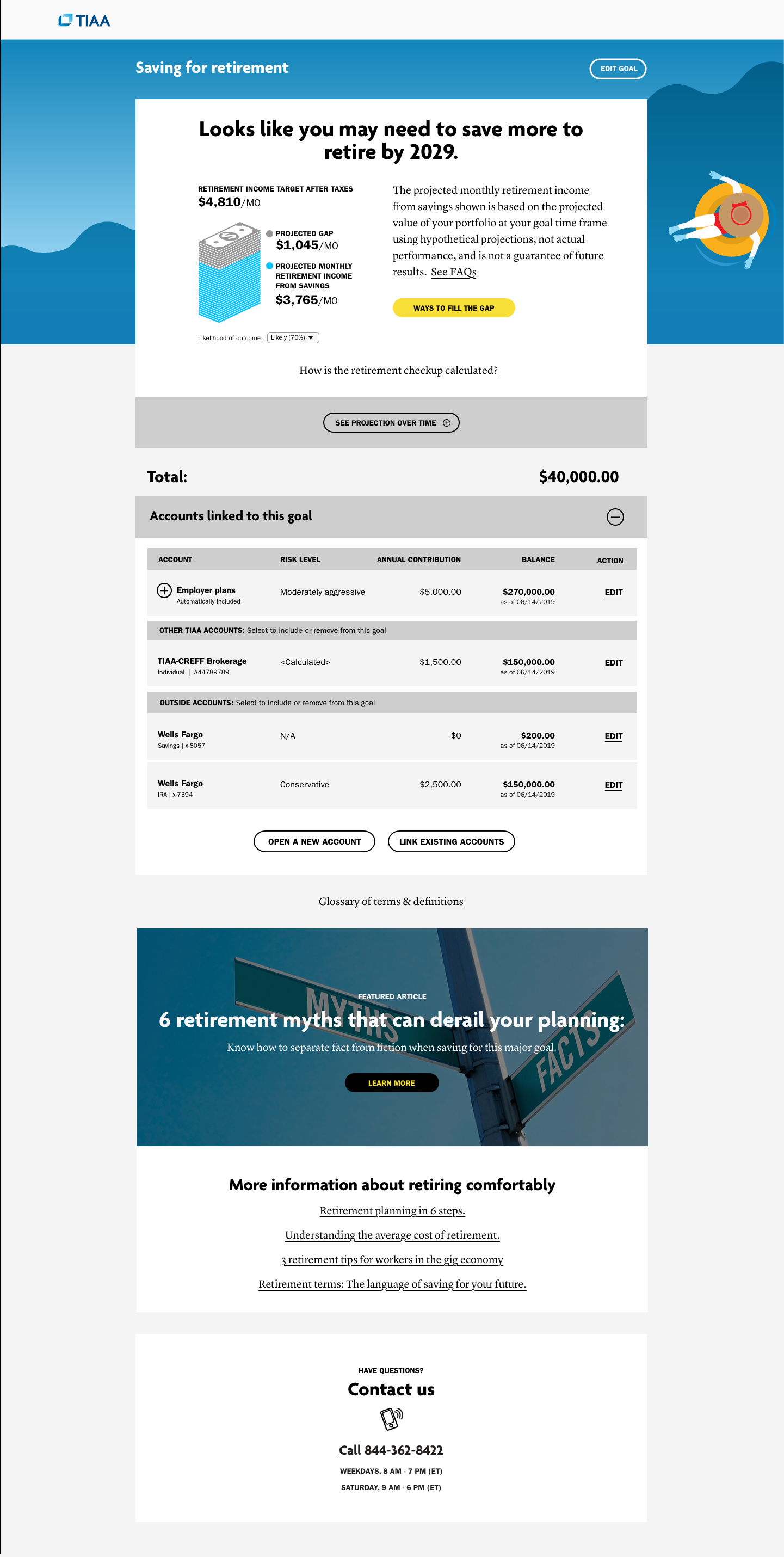

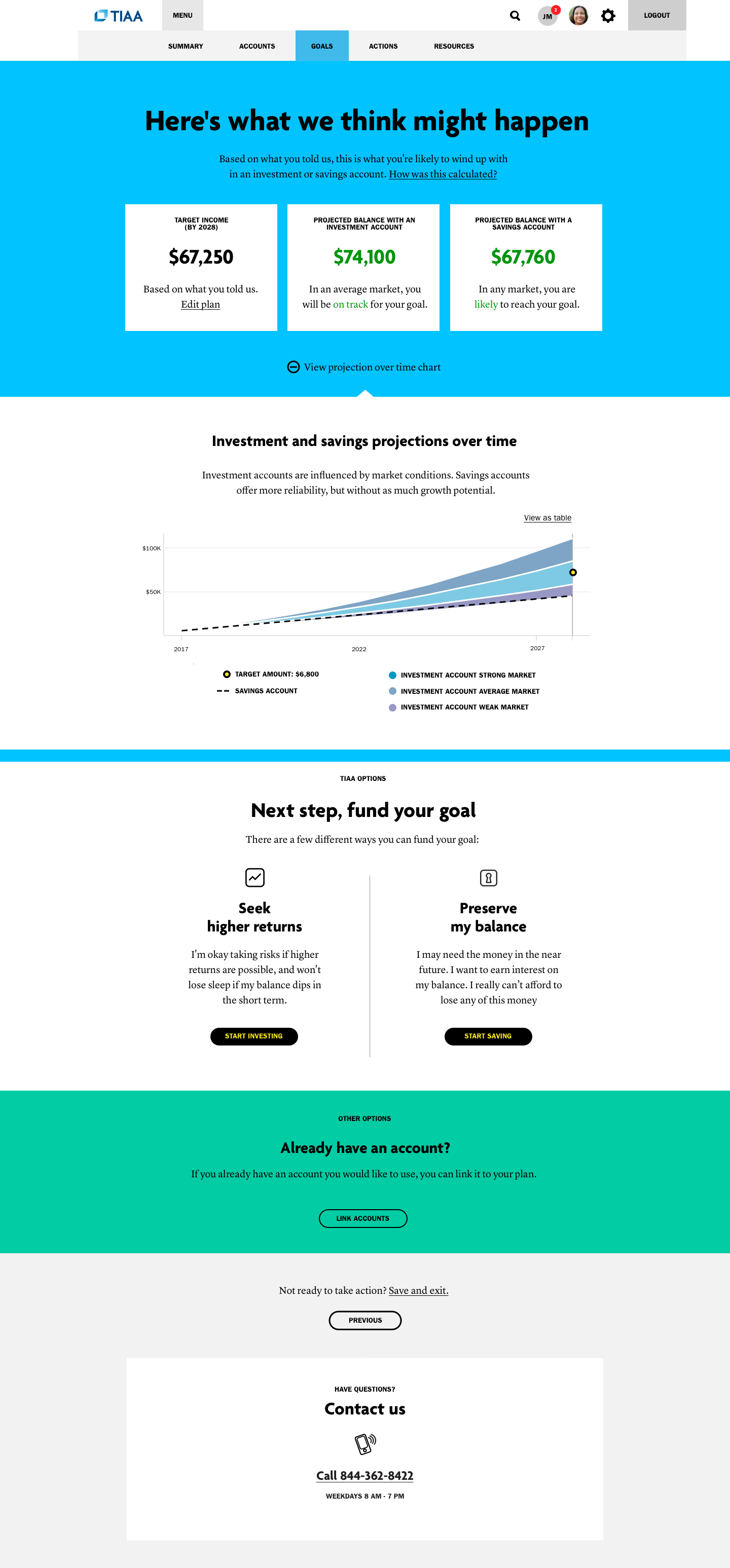

TPP’s financial goal creation and tracking experience was its mechanism for delivering investment advice. However, no matter how well the company educated users on the benefits of investing for long term goals, they still related certain financial goals, like saving for a home, with a bank deposit account. Therefore, we introduced other products suitable for helping users achieve their financial goals, removing the dependency that the goal experience had on the TPP product.

The Digital Advisor experience was designed to:

- Assess and analyze customer’s current financial situation

- Gather customer’s future financial goals

- Create a plan to assist customers with goal achievement by utilizing the appropriate financial products

DESIGNS

REFLECTION

The Digital Advisor project was a great reminder of the importance of fully understanding your customer’s needs and expectations while attempting to help them achieve their goals. If user needs and expectations are met, then value can be reciprocated through customer loyalty and revenue.

As of Dec 2019, we’ve helped users create and track 206,391 goals which have contributed to an additional ~$65M in assets under management.

NEXT STEPS

Even though my team was successful in helping a large number of customers build a plan to improve their financial health, it became evident we were doing our customers a disservice by mainly focusing on accumulation goals. What we did not consider was that a large number of our customers had an overwhelming amount of debt. Before they could increase their savings and bring financial goals to fruition, they wanted to reduce debt, which brought about the company’s next goal to assist customers with debt reduction. The company plans to accomplish this by utilizing the Public Service Loan Forgiveness Program for qualified student loan debt and putting a plan in place for loan and credit card debt.