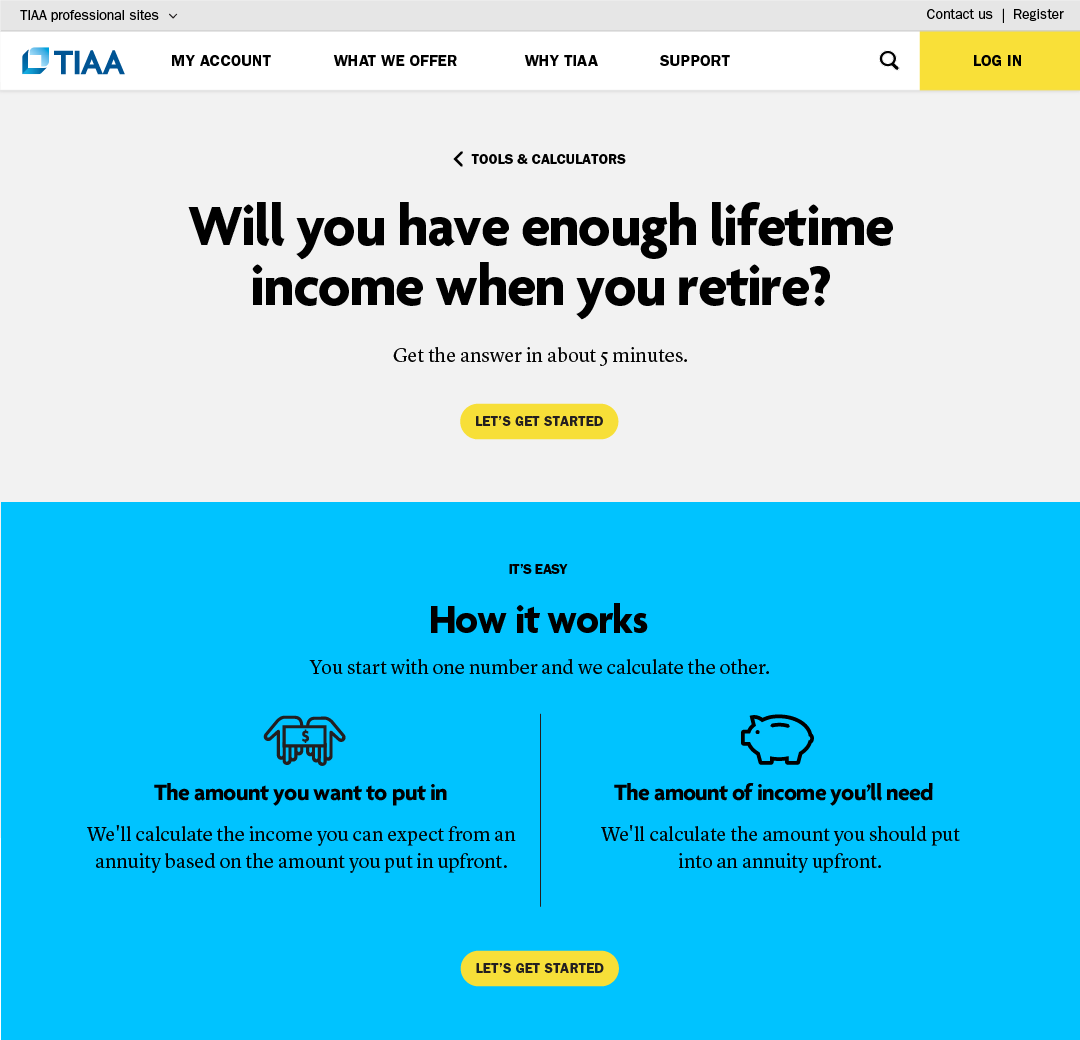

Lifetime Income Calculator

PROJECT DESCRIPTION

In 2016, the company was experiencing a number of calls related to simple annuity questions. Knowing that people usually hesitate to transition from the digital channel to calling a consultant, we could estimate this probably represented only about 10% of the opportunity to engage potential customers. In addition, our competitors like Fidelity and Charles Schwab assisted prospects with “shopping around” digitally by providing tools that illustrated their guaranteed lifetime income products.

To strengthen customer confidence in TIAA annuity products, it was important to also provide an experience that provided lifetime income illustrations via a completely self-directed/digital experience.

Target Audience

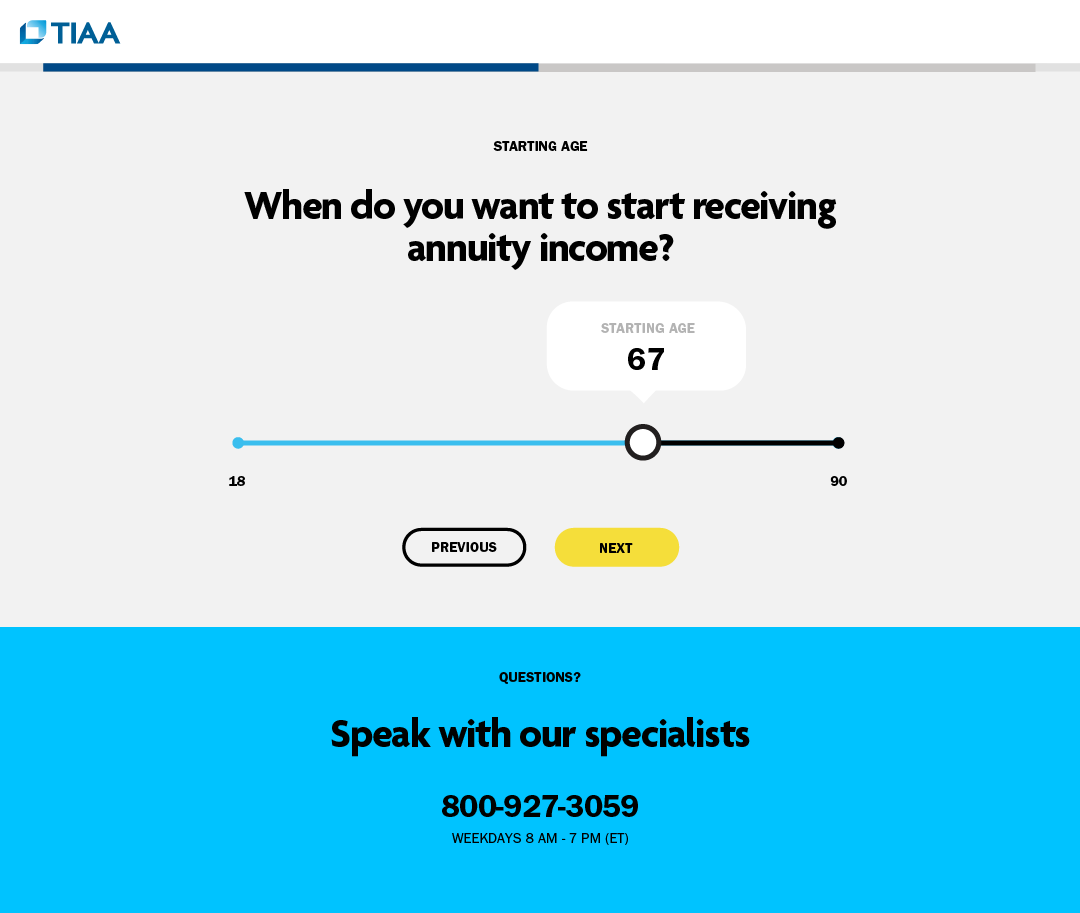

Customers and prospects transitioning into retirement (age 55+ or within 10 years of retirement).

Design objective

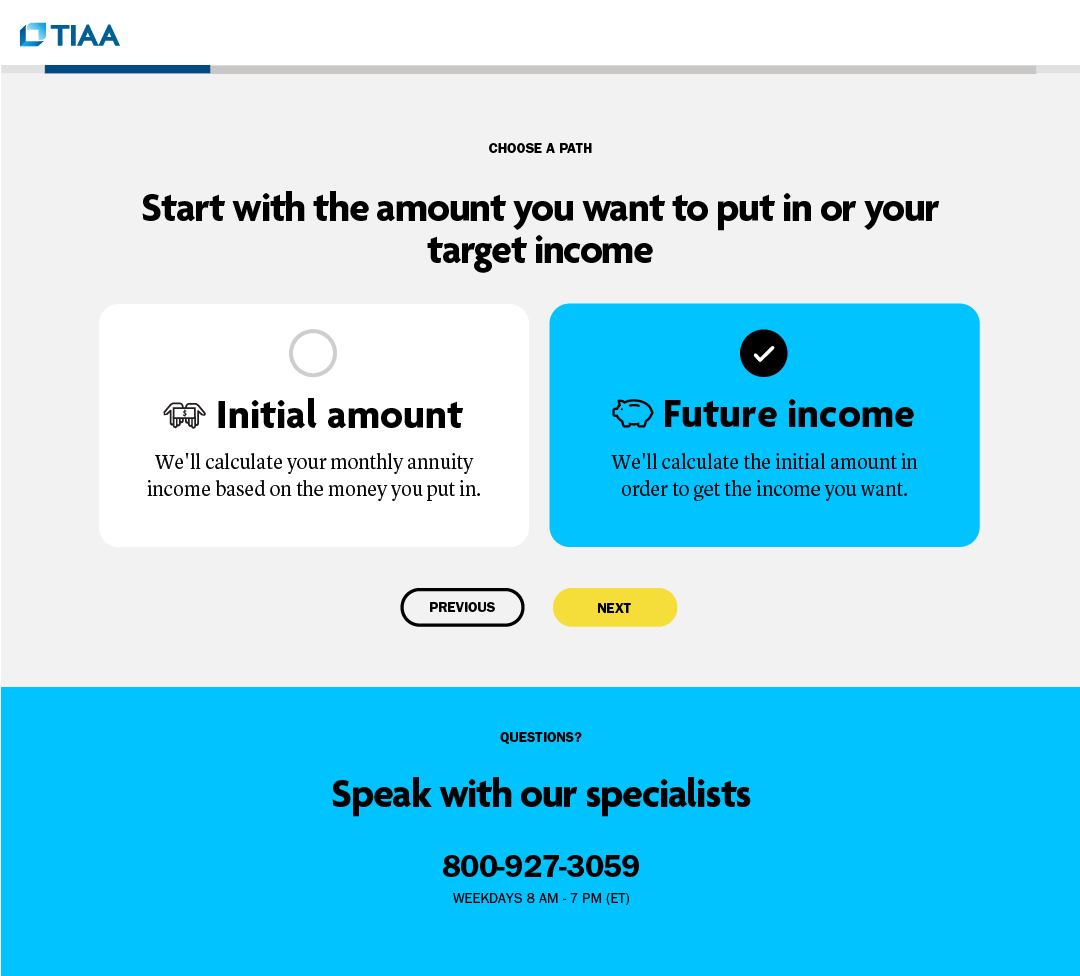

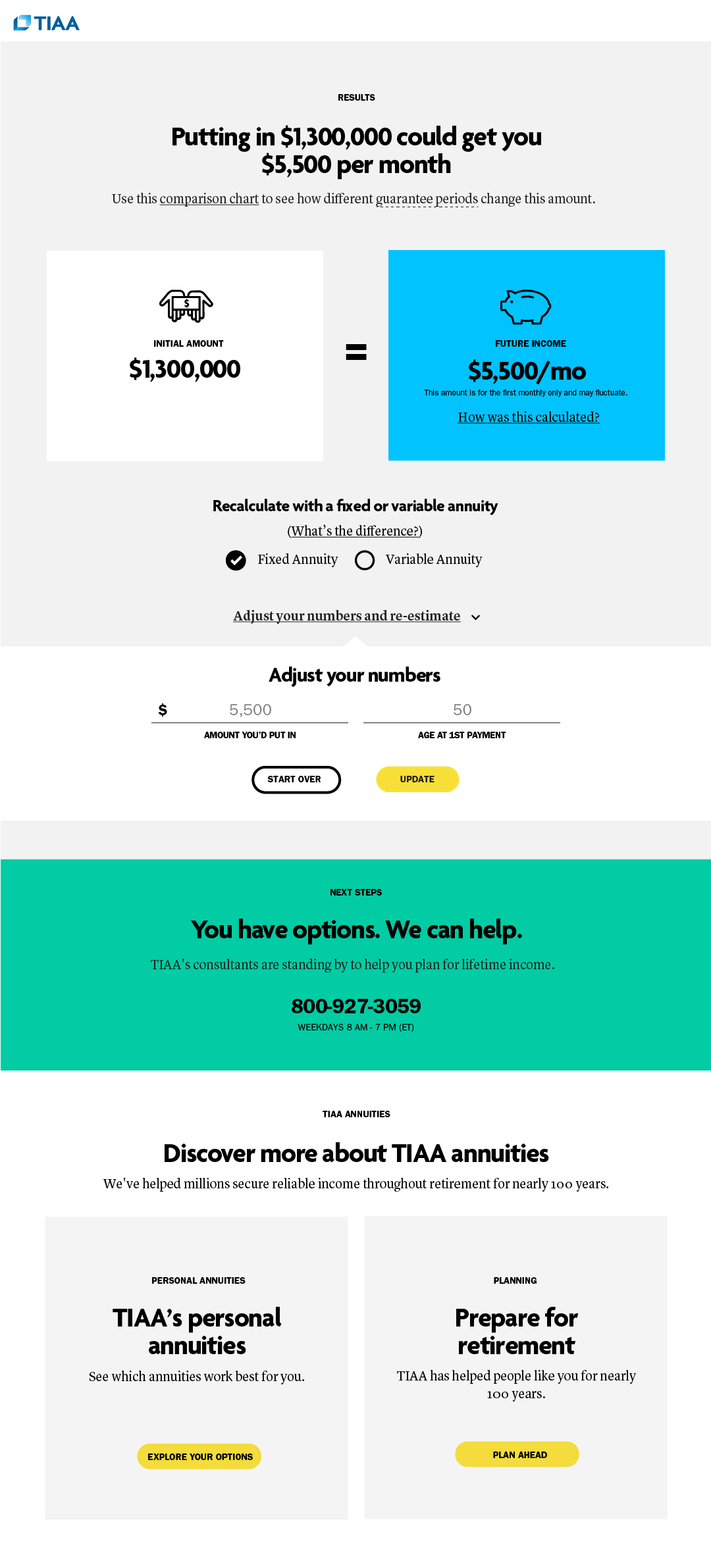

Fill a tool/ calculator gap by designing an experience that allows an individual to easily estimate:

1. How much lifetime income can be generated from investing a specific amount in an annuity

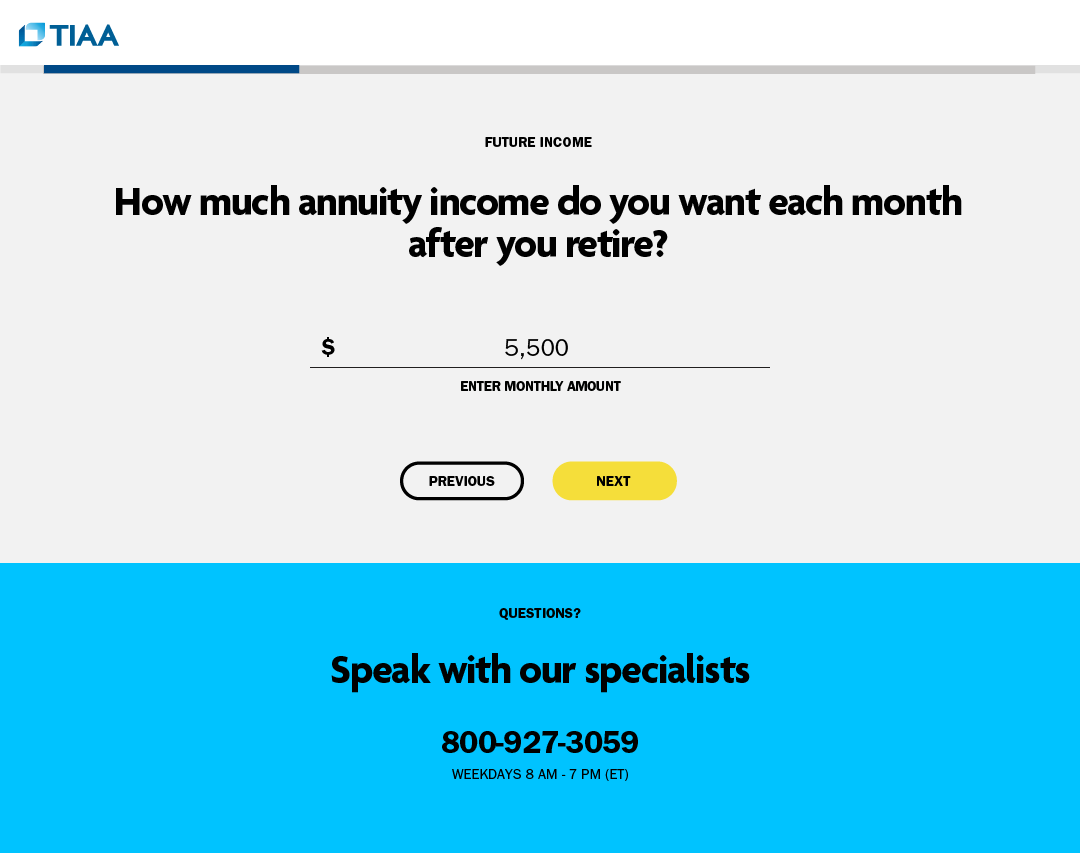

2. How much to invest in an annuity to generate a specific amount of lifetime income

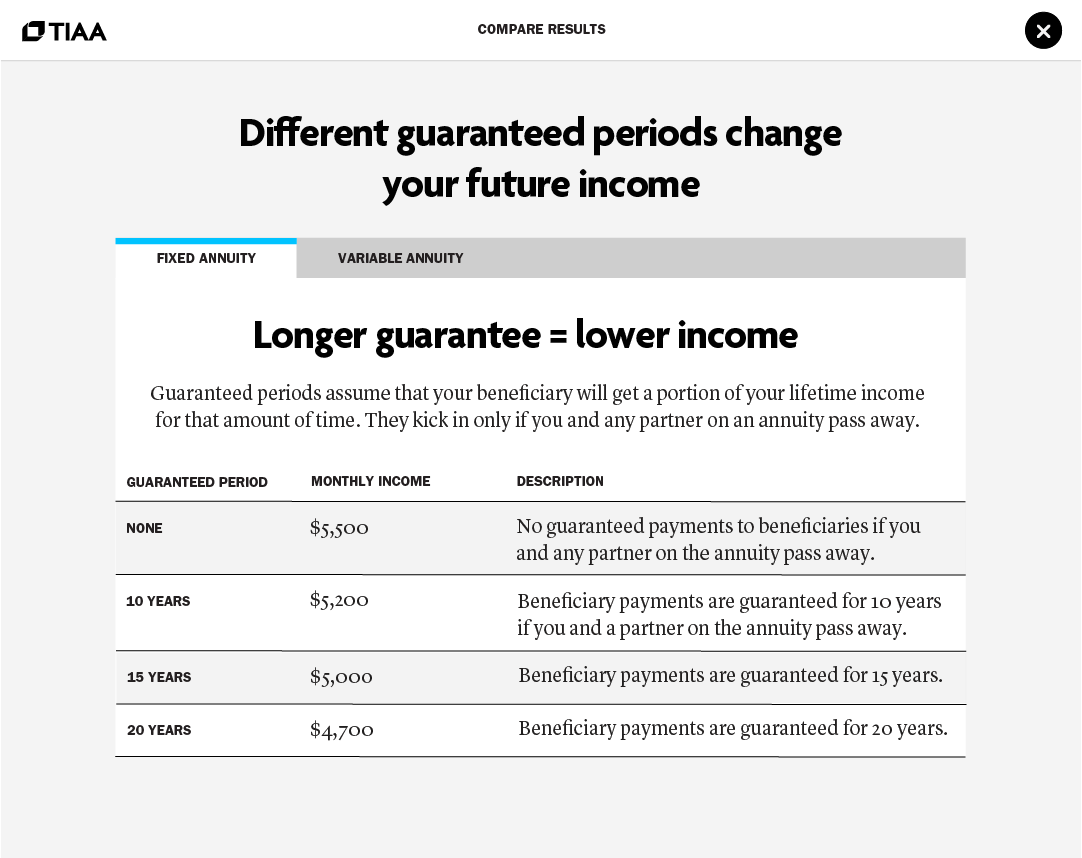

3. How certain annuity features would impact the above calculations, like product choice (fixed income vs variable annuities) covering a spouse’s lifetime, and more.

DESIGNS

REFLECTION

Having an understanding that our competitors already had tools that illustrated their guaranteed lifetime income products, my goal was to improve on those experiences by offering the simplest answer to the simplest question (how much will it cost / how much will I get). After testing the competitor tools, I learned that each tool asked questions that users didn’t know how to answer. So the experience I designed eliminated those questions, provided a simple answer to the user question, while allowing them to dig deeper into the complexity of the options that a TIAA annuity has to offer, like survival benefits for a spouse and/or children.